The Nairobi Stock Exchange (NSE) has registered a significant rebound in the month of March with stocks in several companies rising in the last couple of days.

According to data from the NSE, companies including Safaricom, Kenya Commercial Bank (KCB), I&M Group, and the East African Breweries (EABL) Ltd have all gained in the past few days.

I&M shares, for instance, rose by 8.63% to trade at Ksh 22.65, Umeme Group’s share prices rose by 7.86% to trade at Ksh15.10 while Liberty Kenya’s shares rose by 7.17% to trade at ksh5.38 on March 25.

Similarly, KCB’s shares rose by 6.46% (Ksh27.20), Safaricom by 5.07% (17.60) while Eveready rose by 4.439% to trade at Ksh1.19.

The rise in the prices of shares in the listed companies represent the rebound experienced in the stock market after struggling in 2023.

In a statement on Monday, March 25, NSE announced that the Equities Market had recorded the highest single day turnover in 2024 of Ksh 3 billion on a volume of 141 million shares.

“The Equities Market has recorded the highest single day turnover in 2024 of Kes. 3B on a volume of 141M shares,” NSE announced.

Related to the rebound is the entry of BlackRock, one of the world’s leading providers of investment, advisory and risk management solutions.

Also Read: NSE Appoints Frank Mwiti as New CEO

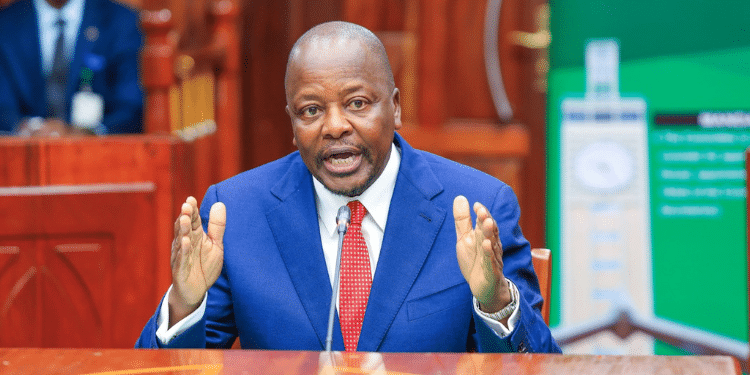

Kamau Thugge reveals details about BlackRock investment

Speaking at event last week, Central Bank of Kenya Governor Kamau Thugge announced that Blackrock had invested into the equities on the NMSE to boost its performance that had dwindled in the previous year.

According to Thugge, the recent gains registered in the stock exchange market is attributable to the entry of the giant asset management company. The CBK Governor who was addressing bankers at the event said that BlackRock had chosen Kenya as one of its investment destinations after keeping off Africa’s markets for close to five years.

Blackrock actually made an investment into the equities and if you are keen and have been looking at what it is happening in the stock market, you can actually see it has been going up,” Thugee said in the meeting as quoted by The Business Daily.

Also Read: 5 Companies Selling Stock for Less Than Ksh1 on NSE

NSE bounces back after slow 2023

NSE had in 2023 experienced turbulent times characterized by exit of foreigners and negative returns. Data from the Capital Markets Authority in October 2023 had indicated that some 6,256 investors had left the NSE in the period between January 2023 to September 2023.

At the time, the total capitalization at the NSE had fallen to the lows of Ksh1.3 trillion, which was a record low for a period of eleven years. However, recent recoveries gained by the Kenyan Shilling against the United States’ dollar could have restored investor confidence in the Kenyan market, with CBK Governor Kamau Thugee citing it as one of the factors that attracted BlackRock.

After hitting the breaching past the Ksh160 sometimes in January, the shilling has rallied against the Dollar since mid-February and is currently exchanging in the region of Ksh130. This has in turn had a ripple effect in the macro-economics with several sectors breathing a sigh of relief after a period of difficult times.