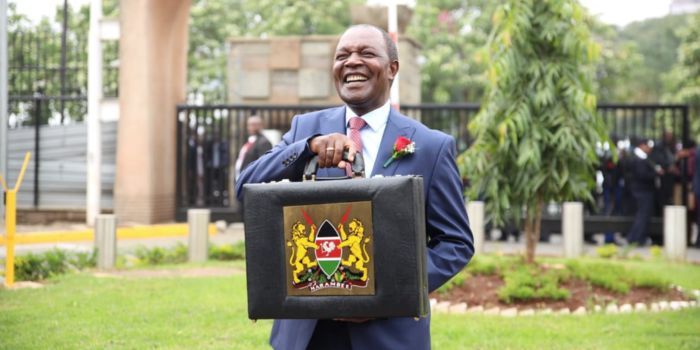

Treasury Cabinet Secretary Njuguna Ndungu has proposed an increase in the excise duty for fees charged on mobile money services including M-Pesa and other money transfer services.

If passed, Kenyans will have to part ways with more cash for the services as the new law will impose an additional five percent excise duty on the money transfer services from the current 15 per cent to 20 per cent.

The proposed Finance Bill also applies the same increase in excise duty for fees charged on money transfer services by agencies and other financial service providers.

The change is made by deleting a clause in the current Finance Act indicating that “Telephone and internet data services shall be charged excise duty at a rate of fifteen percent of their excisable value. 2. Excise duty in fees charged for money transfer services by banks, money transfer agencies and other financial service providers shall be fifteen percent of their excisable value.”

And replacing the two clauses with “by deleting the words “fifteen percent” and substituting therefor the words “twenty percent”; (ii) in paragraph 2, by deleting the words “fifteen percent” and substituting therefor the words “twenty percent”.”

Also Read: CBK Governor Affirms that the Finance Bill Will Have Minimal to No Impact on Inflationary Pressure

Increase in Betting and Gaming Charges in Finance Bill Proposal

At the same time, a five percent increase in exercise duty will be imposed on fees charged for money transfer services by cellular phone service providers, fees charged by financial institutions if the bill is passed.

On the other hand, the National Treasury has proposed an increase in excise duty on betting from 12.5 percent on the amount wagered or staked to 20 percent. However, the excise duty does not apply to horse racing.

Also, the bill has proposed an increase in excise duty on gaming from 12.5 percent on amount wagered or staked to 20 percent.

The excise duty on prize competition which is 12.5 percent of the amount paid or charged to participate in a prize competition in the current Act is to be increased to 20 percent if the bill is passed in parliament.

In addition, excise duty on lottery (excluding charitable lotteries) will be 20 percent, an increase from the current 12.5 percent, of the amount paid or charged to buy the lottery ticket.

Also Read: CS Ndung’u Advises Ruto on How to Make More Money from Taxing Kenyans

Bloggers and Social Media Users Charged for Adverts

On the other hand, bloggers and other internet users will have to dig deeper into their pockets if the bill is passed into law because of newly proposed charges.

In the 2024 Finance Bill, excise duty fees charged on advertisement for television, print media, billboards and radio stations on alcoholic beverages, betting, gaming, lotteries and prize competitions will be introduced for internet users.

The clause eight which states “Excise duty on fees charged on advertisement television, print media, billboards and radio stations on alcoholic beverages, betting, gaming, lotteries and prize competitions shall be at the rate of fifteen percent,” is altered.

Instead, its proposed replacement indicates “in paragraph 8, by inserting the words “the internet, social media” immediately after the words “advertisement on”.

Follow our WhatsApp Channel for real-time news updates:

https://whatsapp.com/channel/0029VaB3k54HltYFiQ1f2i2C