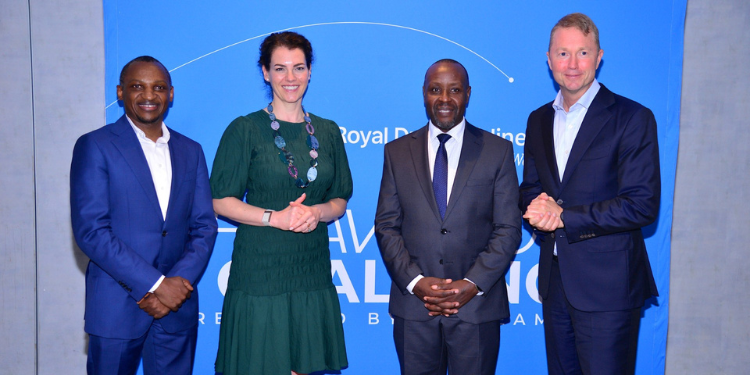

KCB Group Plc has entered into an agreement to acquire a minority stake in Pesapal Limited. This marks KCB expansion into Kenya’s fast-growing fintech ecosystem.

In a statement released on October 31, 2025, the lender said, “We are delighted to inform our shareholders and the investing public that KCB Group Plc has entered into an agreement to acquire a minority stake in Pesapal Limited.”

The bank described Pesapal as a limited liability company licensed by the Central Bank of Kenya as a payment service provider.

“The investment is subject to conditions that are customary to transactions of this nature, including receipt of regulatory approvals from the Central Bank of Kenya.”

The announcement, signed by Group General Counsel and Company Secretary Bonnie Okumu, stated that the move sets the stage for the development of innovative payment and other related solutions for Kenya’s small and micro enterprises, enhancing value for shareholders of both Pesapal and KCB.

Also Read: Kenyan Opens Fake KRA Page, Starts Collecting Tax

KCB added that the deal remains “subject to conditions that are customary to transactions of this nature, including receipt of regulatory approvals from the Central Bank of Kenya.”

KCB Strong Financial Performance Fuels Expansion

The acquisition comes amid KCB’s strong financial performance. In its full-year 2024 results, the lender reported a net profit of Ksh 61.8 billion, representing a 65 percent increase from the previous year, driven by increased lending and regional growth.

Its asset base grew to approximately Ksh2.0 trillion, solidifying its position as one of East Africa’s largest banks. In the first half of 2025, KCB posted a 7 percent rise in pretax profit to Ksh40.83 billion, while net interest income climbed to Ksh 69.1 billion from Ksh61.3 billion a year earlier.

The bank also rewarded shareholders with about Ksh 13 billion in combined interim and special dividends, reflecting its robust earnings momentum.

Pesapal’s Growing Footprint

Pesapal, founded in Kenya, has evolved into one of East Africa’s leading digital payment platforms, enabling businesses to accept mobile money, card, and online payments.

Also Read: All Banks Put on Notice: Here is Why and How Assets Become Unclaimed

The company’s flagship Sabi Point-of-Sale terminal enables merchants to process both local and international payments seamlessly, while its app provides users with options to pay bills, book flights, purchase airtime, and make school fee payments directly.

Pesapal’s solutions primarily target small and medium-sized enterprises (SMEs), a segment that aligns closely with KCB’s retail and business banking strategy.

By investing in Pesapal, KCB aims to leverage the fintech’s technological agility and digital reach, thereby strengthening its capacity to deliver real-time, customer-centric payment experiences.

Follow our WhatsApp Channel and X Account for real-time news updates.

![Senator Allan Chesang And Chanelle Kittony Wed In A Colourful Ceremony [Photos] Trans Nzoia Senator Allan Chesang With Channelle Kittony/Oscar Sudi]( https://thekenyatimescdn-ese7d3e7ghdnbfa9.z01.azurefd.net/prodimages/uploads/2025/11/Trans-Nzoia-Senator-Allan-Chesang-with-Channelle-KittonyOscar-Sudi-360x180.png)