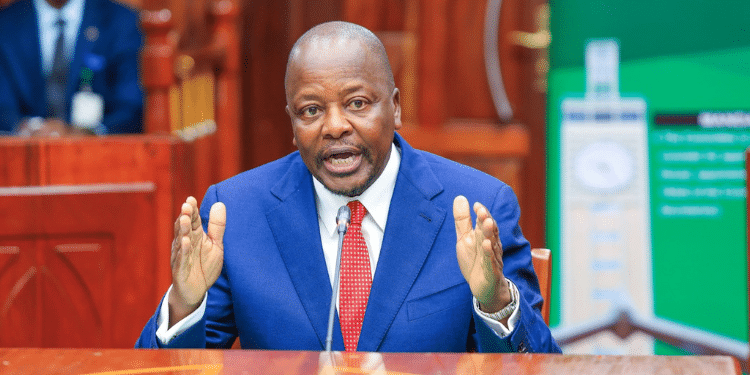

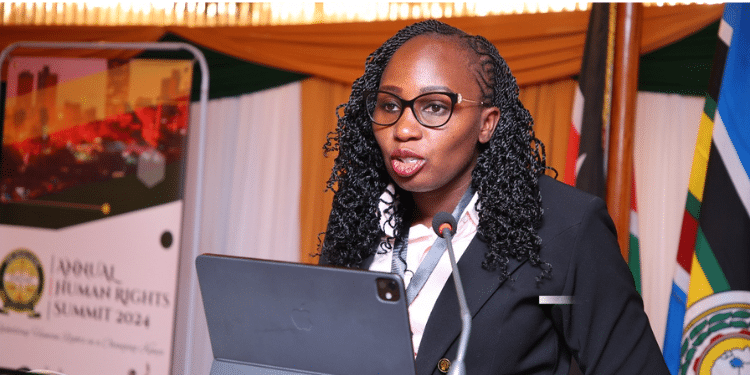

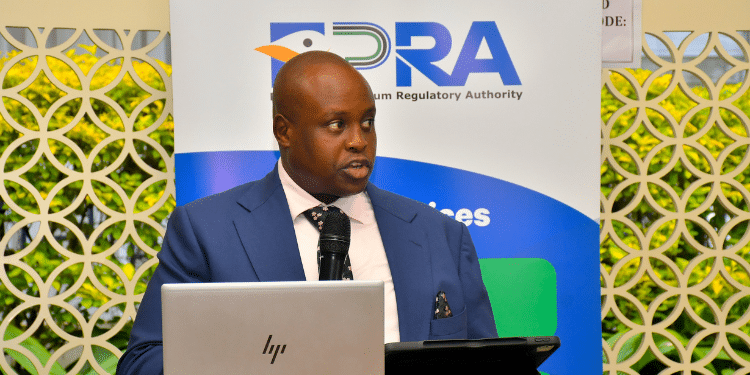

National Treasury Cabinet Secretary Njuguna Ndung’u on Thursday 28, 2023 issued a statement regarding the repayment of Eurobond debt.

CS Ndung’u noted that Kenya is dedicated to fulfilling all its debt obligations with international lenders as part of its efforts to maintaining a good credit rating.

“In its unwavering commitment to upholding a resilient sovereign credit rating and facilitating access to new development financing, Kenya remains dedicated to fulfilling all debt obligations with international lenders,” the statement reads in part.

According to the CS, Kenya paid $68.7 million (Kshs 10.8 billion) in interest, which is a necessary instalment on the US$2 billion Eurobond.

In addition, the treasury boss said this payment was possible through prudent use of revenue collections.

Also Read: Treasury CS Issues Directive on Govt Pending Bills

“Recently, Kenya successfully executed a payment of US$68.7 million (equivalent to Kshs 10.8 billion) in interest, a necessary instalment on the US$2 billion Eurobond

This financial commitment, achieved through prudent use of revenue collections, underscores Kenya’s steadfast dedication to meeting external obligations,” the statement further reads.

Furthermore, CS Ndung’u noted that this timey settlement of the Eurobond has not only sent a positive signal to investors but also resulted in a reduction in yields on Kenya’s Eurobonds in the global financial markets.

He announced that the final interest payment on the Eurobond is scheduled for the last week of June 2024, alongside the repayment of the principal amount of $2 billion.

Nonetheless, the treasury CS revealed that the since July 2023, the government diligently implemented a comprehensive plan for debt service payments, combining revenue and concessional financing to retire high-cost debts within the national debt portfolio.

National Treasury on External Loans

In the Thursday evening statement shared by the government spokesperson, the CS reported that substantial external inflows from the World Bank, IMF, and other Development Finance Institutions, in addition to key bilateral partners, are anticipated between January and March 2024.

According to the Treasury Cabinet Secretary, these inflows are poised to significantly bolster foreign exchange reserve levels.

He added that despite a slow start in revenue collection at the fiscal year’s commencement, the preliminary outcome for the six months ending December reflects an impressive turnaround.

Also Read: Ruto Begs World Bank and IMF for More Loans to Pay Eurobond

This positive shift is attributed to the government’s tax policy and administrative reforms.

Nonetheless, the treasury CS echoed that Kenya maintains a robust economic outlook supported by policy reforms and collaborations with multilateral and bilateral development partners.

“The ongoing fiscal consolidation plan, driven by revenue generation, aims to curtail borrowing, reduce debt levels over the medium term, and ultimately enhance the well-being of Kenyans,” the statement reads.