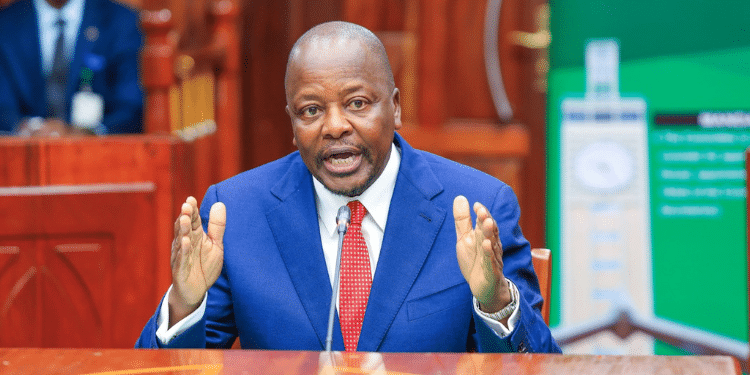

President William Ruto has announced an increase in the Hustler Fund loan limit, tripling the amount to 1.5 million Kenyans.

Speaking during the anniversary of the fund, Ruto said that other borrowers will be rewarded for repaying the loans and saving continuously.

The initiatives aim to further empower the underserved population and drive financial inclusion.

“We have also launched a new product. The Bridging loan. It will allow every borrower in the Hustler Fund ecosystem, the good borrowers will be able to triple their credit borrowing.

“Those with a limit of Ksh50,000 can now move to Ksh150,000 and those at Ksh5000 will move to Ksh15,000. There are those who will be able to increase their limit because of their behaviour by 1.5 percent, but others will not have any increase because they have not behaved well,” said the head of state.

Also Read: Hustler Fund: Why President Ruto’s Plan to Loan Money to Entrepreneurs Hasn’t Worked

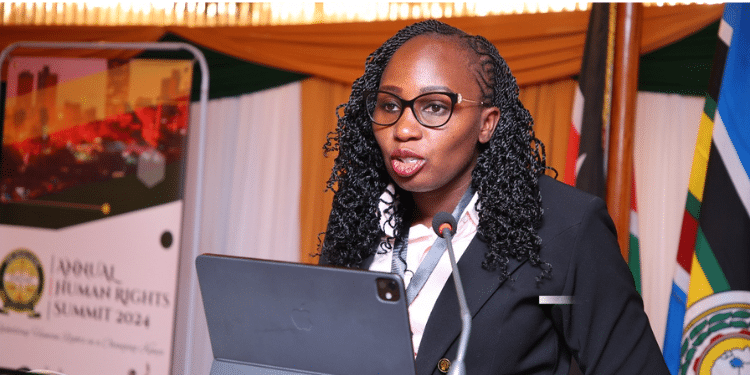

Ruto Announces New Credit Scores

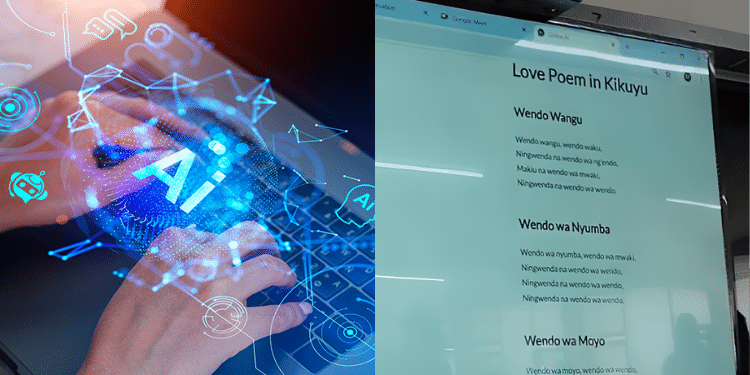

Additionally, the fund assigns credit scores for borrowers on the fund that can be used to borrow loans from other financial institutions as well.

“We are assigning a credit score to every borrower it becomes their new collateral. they will use it within their hustler fund ecosystem and other financial institutions.

Since its launch in 2022, the Hustler Fund has been a vital source of financial support for millions of low-income Kenyans.

President Ruto highlighted that the Fund is not merely a short-term fix but a step toward long-term development.

“The Hustler Fund is not an end, it is a means to an end. It’s a pathway to better jobs, better businesses, and better futures,” he added.

Also Read: Govt Targets MPESA & Airtime of Hustler Funds Defaulters in Looming Crackdown

How the Ranking will be Implemented

The behavioural credit rating system will replace traditional collateral by assessing creditworthiness based on borrowing habits.

President Ruto explained that beneficiaries will be rated on a scale from A1 (Excellent) to C3 (Poor), promoting responsible borrowing while expanding access to credit.

The system features nine credit bands: A1, A2, A3, B1, B2, B3, C1, C2, and C3, reflecting an individual’s creditworthiness.

Ruto highlighted that over two million Hustler Fund beneficiaries have already exhibited strong borrowing discipline, with many qualifying for higher loan limits as a result.

He also unveiled plans to introduce KNEST, a long-term savings management initiative, in two months. The program aims to enhance financial security for Kenyans alongside improved credit access.

Follow our WhatsApp Channel and join our WhatsApp Group for real-time news updates.