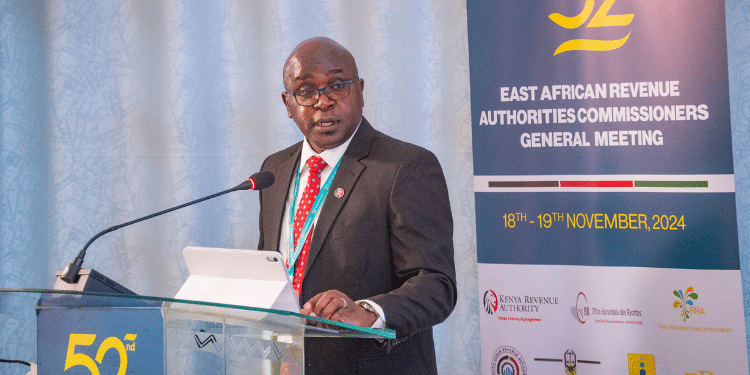

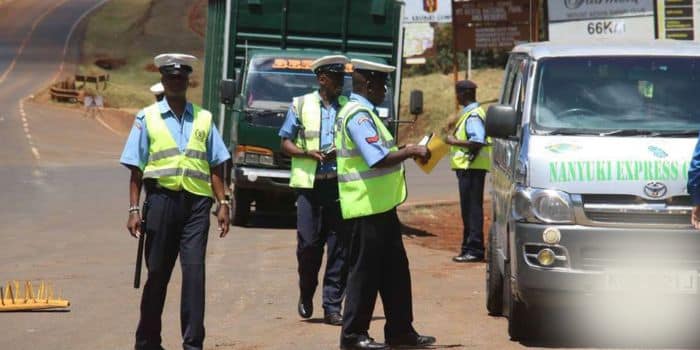

Directline Assurance, which commanded the lion’s share of the motor commercial Public Service Vehicle (PSV) insurance market in Kenya, on Tuesday, September 10, announced that it will stop issuing insurance services with immediate effect.

Citizen TV reported that the company said the decision came after fraudsters infiltrated the firm claiming to be the shareholders of the company.

Consequently, the Association of Kenya Insurers (AKI) has been directed not to issue any insurance documents under the name of Directline Insurance Company starting from Tuesday, September 10.

Furthermore, all banks in partnership with Directline have been informed that the ownership documents of the company, specifically the CR12 forms being circulated, are counterfeit.

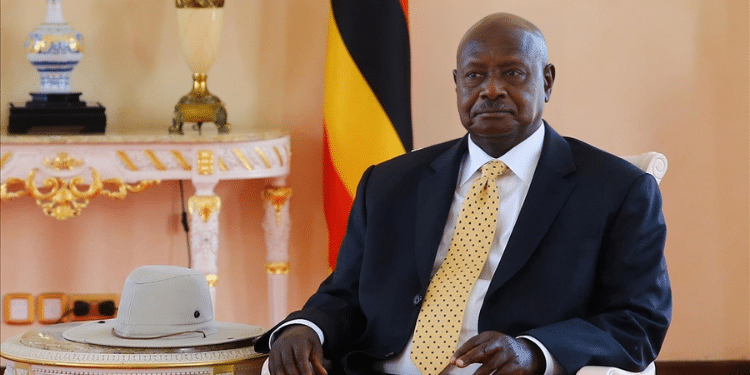

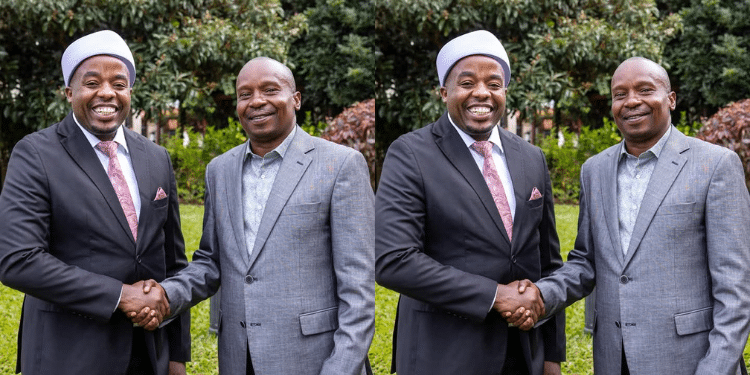

Also, the banks are not authorized to conduct any transactions that have not been approved by the legitimate shareholders, who are Royal Credit Limited, SK Macharia, and Mrs. Macharia.

Why Directline Has Stopped Offering Insurance Services

The company’s shareholders have blamed the Insurance Regulatory Authority (IRA) for allegedly approving and continuing to approve the issuance of the counterfeit CR12 documents, despite being aware of the fraud that has been occurring since 2005.

They mentioned that the counterfeit CR12 document has been used to mislead the court into making decisions that undermine the rights of the legitimate shareholders of the company.

Additionally, those mentioned in the counterfeit CR12 document are neither shareholders nor directors of the company according to SK Macharia and his team.

Also Read: Insurance Company Flags 100 Motor Vehicle Policies

Shutdown of Directline Assurance

This comes after Royal Credit chairperson S.K. Macharia in June announced the shutdown of the company with all employees dismissed effective immediately.

Macharia explained that the decision was a result of the closure of all the bank accounts belonging to Directline by the IRA.

However, Macharia accused the IRA of failing to act against the directors of Directline, who he alleged misused Ksh 7 billion belonging to the company.

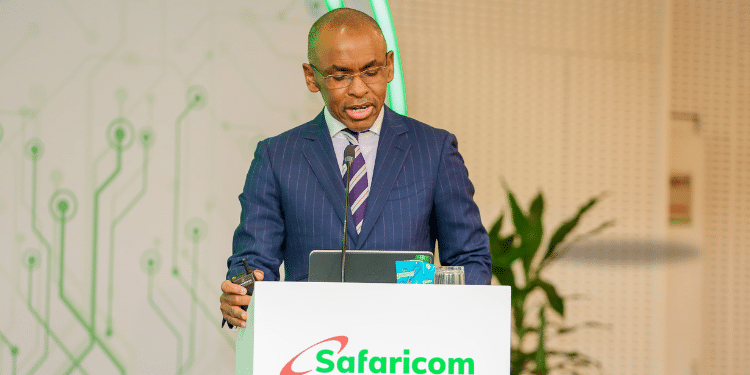

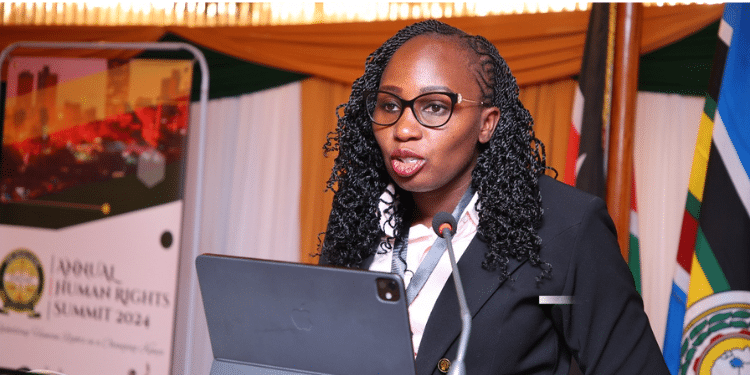

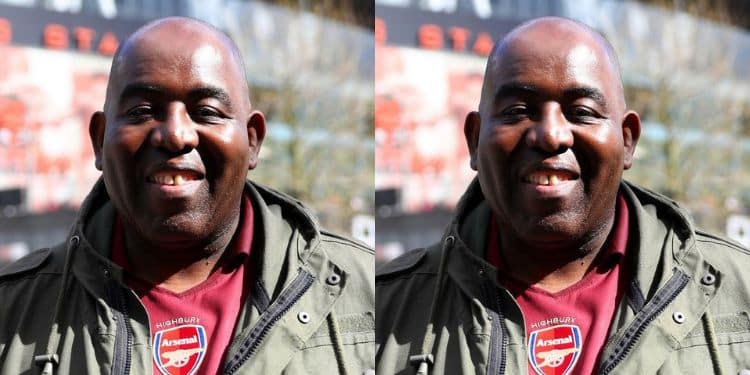

Consumers Federation of Kenya (COFEK) Secretary General Stephen Mutoro attributed the closure to the predicted hard economic times presented by the Finance Bill 2024.

He further stated that individuals with insurance coverage from the company will be unable to make claims after the closure.

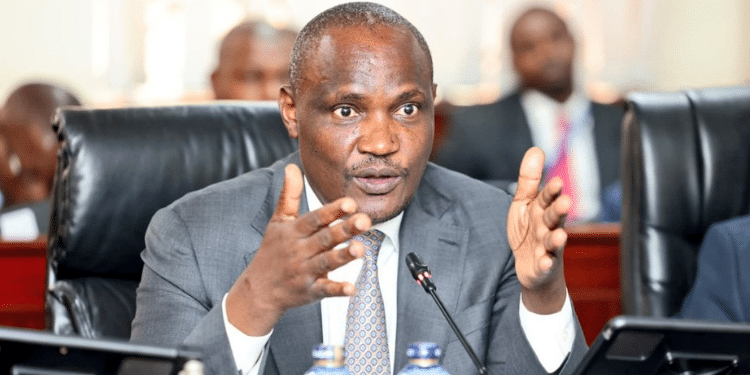

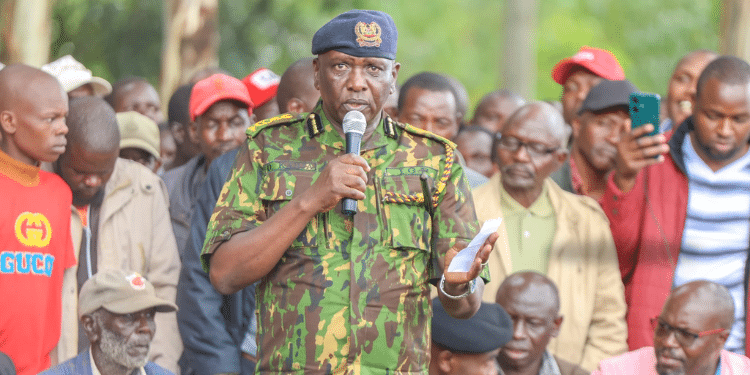

IRA Hits Back at Macharia Over Directline Shutdown

In response, IRA termed the actions as null and devoid of any legal effect and as such the insurer continues in full operation as licensed and approved by the Authority.

“The purported transfer of the assets of the insurer to any third party is therefore null and void ab initio,” IRA said in a statement.

IRA stated that all policies issued by Directline Assurance Company Limited remain in full force and effect and the insurer remains liable for any claims arising therefrom.

Furthermore, it mentioned that policyholders of the insurer may continue with their operations in accordance with their insurance contracts.

The Authority added that it has the sole statutory mandate to approve, suspend or cancel the operations of any insurance company in Kenya and this duty cannot be usurped by any unauthorized party.

“The insurer has been placed under heightened surveillance by the Authority and the Authority will take necessary steps as may be appropriate, pursuant to the provisions of the Insurance Act, CAP 487 Laws of Kenya, to ensure sustainability of the insurer and protection of insurance policyholders’ interests,” added IRA.

Follow our WhatsApp Channel for real-time news updates:

https://whatsapp.com/channel/0029VaB3k54HltYFiQ1f2i2C