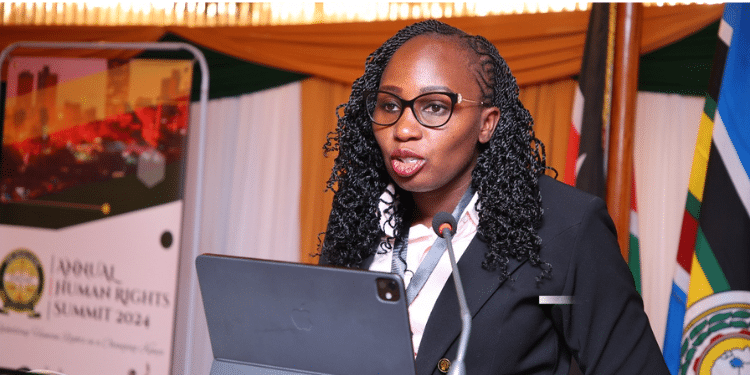

The African Union (AU) body, the African Peer Review Mechanism (APRM), has strongly disagreed with Moody’s Global Credit Rating Agency’s recent decision to revise Kenya’s economic outlook from negative to positive.

APRM, which supports African countries in matters of credit ratings, routinely analyzes rating actions and commentaries issued by international credit rating agencies.

On Friday, January 24, Moody’s announced its revised credit outlook for Kenya, shifting it from negative to positive.

According to Moody’s, this adjustment reflects an increasing likelihood of easing liquidity risks and improving debt affordability over time.

“Domestic financing costs have started to decline amid monetary easing and could continue to do so if the government sustains its more effective management of social demand and fiscal consolidation. Such a track record would also boost Kenya’s access to both concessional and commercial external funding,” Moody’s stated.

Moody’s Revises Kenya’s Credit Outlook to Positive

The agency added that improved revenue collection efforts, if successful, could further enhance Kenya’s debt affordability, despite challenges in significantly expanding and sustaining revenue in the past.

Moody’s stated that domestic financing costs have begun to decline amid a monetary easing cycle, and this trend could continue if Kenya effectively manages its fiscal consolidation, thereby opening doors for external funding options.

“Given low inflation and a stable exchange rate, there is potential for further reductions in domestic borrowing costs as past monetary policy rate cuts pass through to lower long-term borrowing costs,” Moody’s said.

However, in a statement issued on Tuesday, January 27, APRM criticized Moody’s action as both irresponsible and detrimental, leading to unnecessary costs to governments, triggering Eurobond sell-offs, and sustaining a negative sentiment on African instruments.

Also Read: Kenya’s Credit Outlook Revised to Positive, Rating Affirmed Ahead of Finance Bill 2025

Why AU Body, APRM Disagrees with Recent Rating

The AU body expressed concerns about the unusual decision to shift directly from a “negative” to a “positive” outlook, bypassing a “stable” rating.

“The APRM notes with concern the errors in recent credit rating actions by Moody’s. On January 24, 2025, Moody’s changed Kenya’s outlook from ‘negative’ to ‘positive’ and reaffirmed its Caa1 rating, citing a potential ease in liquidity risks and improving debt affordability over time,” the statement read.

“It is rare for a credit rating agency to move from ‘negative’ to ‘positive’, skipping a ‘stable’ outlook.”

The APRM further argued that the move was a corrective admission that the previous “negative” outlook to Caa1″ from “B3″had been an inaccurate rating.

It pointed out that this reversal followed Moody’s premature decision on July 8, 2024, to assign a “negative” outlook, influenced largely by protests in Kenya over the proposed Finance Bill.

“The July 2024 rating downgrade by Moody’s was speculative, as midterm review data on the Appropriation Bill, the spending allocations, the final budget, the finance bill, and the new cabinet had not yet been released when the rating agency made its announcement,” APRM stated.

Also Read: Kenya’s Economic Growth to Outpace US & China in 2025

The body pointed out that this is not the first time Moody’s has acted prematurely and erred in its analysis.

It revealed that in January 2023 Moody’s also erred by downgrading Nigeria from ‘B3’ to ‘Caa1’ citing that the government’s fiscal and debt position was expected to deteriorate further under the new administration.

According to APRM, such abrupt changes in ratings undermine the credibility of international agencies and could have broader implications for Kenya’s economic reputation and investor confidence.

“Moody’s is strongly encouraged to be diligent and wait for the complete term review data before taking rating actions rather than taking speculative and premature rating actions based on missing or incomplete information,” the AU body added.

Follow our WhatsApp Channel and join our WhatsApp Group for real-time news updates.