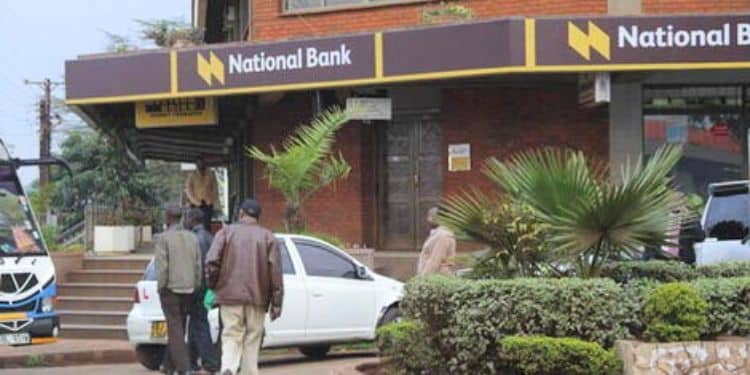

National Treasury Cabinet Secretary (CS) John Mbadi has approved the full acquisition of the National Bank of Kenya (NBK) by Nigeria’s Access Bank.

The approval, which marks a significant move in the banking sector, was announced in a gazette notice dated April 11, 2025.

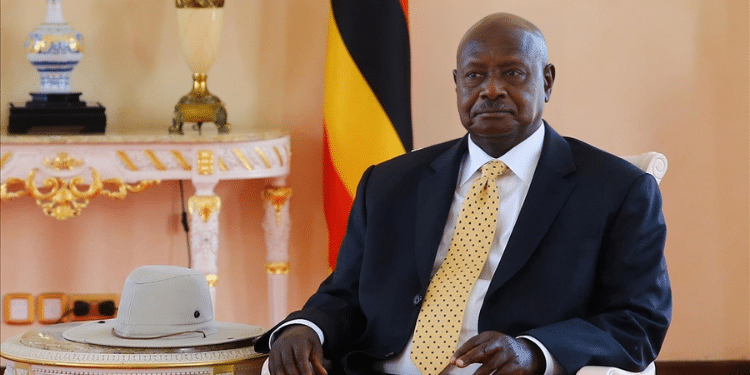

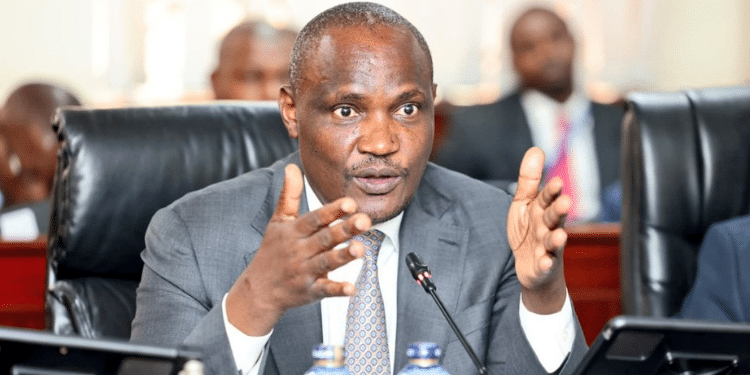

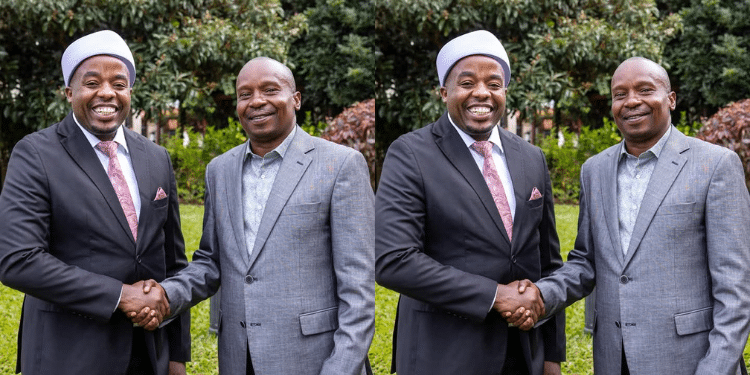

In the notice, Central Bank of Kenya (CBK) Governor Dr. Kamau Thugge confirmed that CS John Mbadi, has approved the transaction.

This acquisition allows Access Bank to take up 100% ownership of National Bank, effectively removing National Bank and its bad debt overhang from the books of the Kenya Commercial Bank (KCB) Group, which previously held a majority stake.

It also gives Access Bank control of NBK’s insurance-related subsidiary, NBK Bancassurance Intermediary Limited (NBBIL).

“It is notified for information of the general public that pursuant to the provisions of Section 9(5) of the Banking Act, the Board of Directors of KCB Group PLC vide a resolution passed on March 20, 2024, approved the acquisition of 100 percent of the issued share capital of National Bank of Kenya Limited by Access Bank PLC as per the Share Purchase Agreement dated March 20, 2024,” read the notice in parts.

“The transaction will be tabled at the next Annual General Meeting of shareholders.”

CS Mbadi Approves Sale of National Bank Kenya to Access Bank

The Board of Directors of Access Bank PLC had approved the acquisition of 100 percent of the issued share capital of National Bank of Kenya Limited as per the Share Purchase Agreement dated March 20, 2024.

“Pursuant to section 13 (4) of the Banking Act, the Central Bank of Kenya on April 4, 2025, approved the acquisition of 100 percent of the issued share capital of National Bank of Kenya Limited by Access Bank PLC,” the notice read further.

“Pursuant to section 9 (1) of the Banking Act, the Cabinet Secretary for The National Treasury and Economic Planning on April 10, 2025, approved the acquisition of 100 percent of the issued share capital of National Bank of Kenya Limited by Access Bank PLC.”

Also Read: KCB Reduces Interest Rates on New and Existing Loans

CAK on Fate of Employees

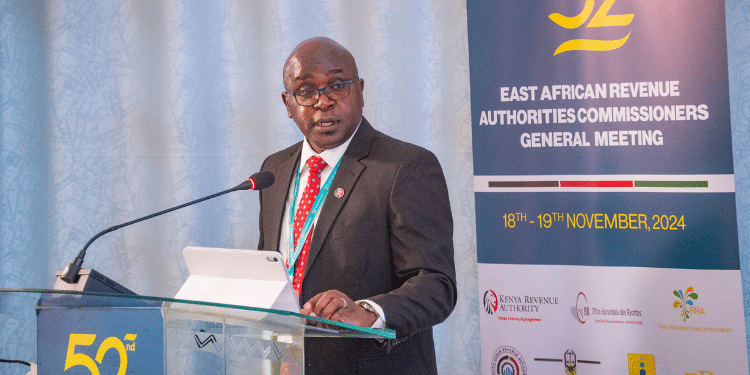

The Competition Authority of Kenya (CAK), in October last year, approved a plan to sell all shares of the NBK.

CAK reviewed whether this acquisition could harm competition in Kenya’s financial sector and determined that it would not.

To cushion the impact on jobs, CAK approved the sale on condition that Access Bank retains at least 80% of NBK’s current workforce.

The affected employees will continue working for the bank for at least one year after the acquisition is finalized.

“The transaction has been approved on condition that Access Bank Plc retains, for one (1) year following completion of the transaction, at least 80% of the target’s current workforce and all Access Bank (Kenya) Plc employees, its local subsidiary,” read the statement in part.

Also Read: Employees Fate Decided as Nigerian Bank Takes Over National Bank

About Access Bank

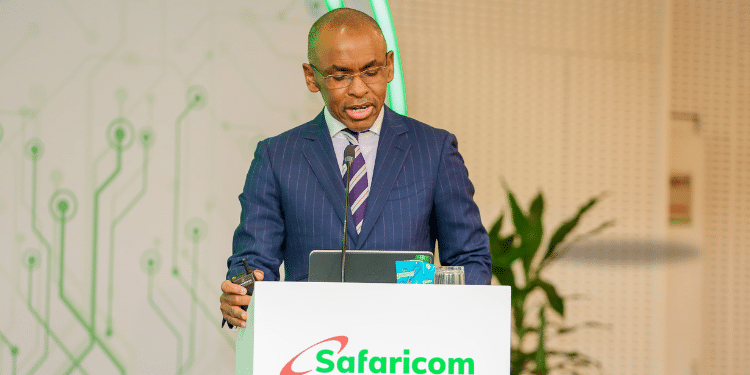

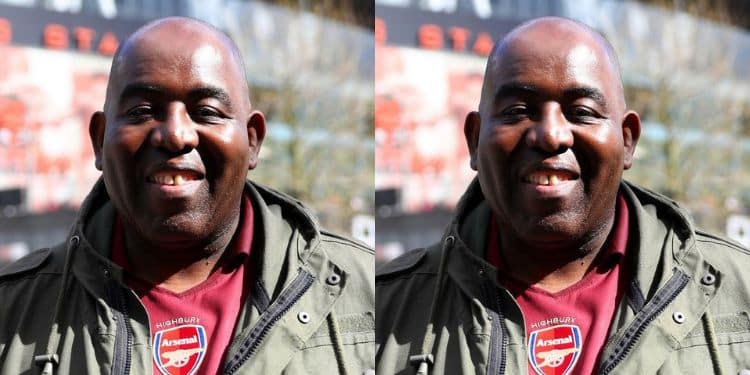

Access Bank is a full-service financial institution listed on the Nigerian Stock Exchange and regulated by the Central Bank of Nigeria.

In Kenya, it operates as Access Bank (Kenya) Plc, providing both retail and corporate banking services through 23 branches across 12 counties.

NBK is a Kenyan commercial bank fully owned by KCB Group Plc since its acquisition in 2019. KCB Group is a public company listed on the Nairobi Securities Exchange.

Also, it is cross listed on stock exchanges in Tanzania, Uganda, and Rwanda.

Follow our WhatsApp Channel and X Account for real-time news updates.