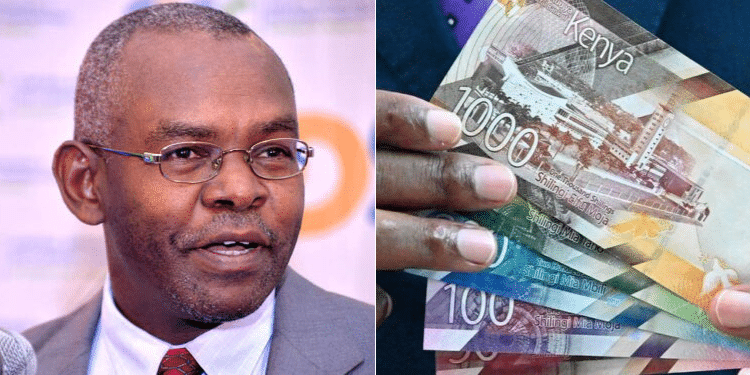

The Kenya shilling is projected to maintain its stability in the coming week, despite fluctuations in other regional currencies.

Traders noted that the Kenyan shilling was flat on Thursday, September 12, even as foreign currency demand saw a slight increase.

London Stock Exchange Group (LSEG) data quoted Kenya shilling at Ksh 128.50/129.50 per dollar, compared with Ksh128.25/129.25 at last Thursday’s close.

“We’re seeing some increased (dollar) demand from oils and corporates, but generally we’re stuck within a range. … It’s likely to stay that way for the next few days,” one trader said.

“The shilling has reached a stable zone.”

Why Kenya Shilling is Stable

The local unit rallied strongly early this year as concerns eased that Kenya would default on a $2 billion (Ksh 256,600,000,000) Eurobond that matured in June, but it lost momentum from April onwards.

In February, the government said it would buy back more than $1.4 billion (Ksh 179,620,000,000) of its $2 billion Eurobond via a tender offer launched that month for a new bond.

Also Read: How Kenyans in the Diaspora Are Stabilizing the Shilling

The government said at the time the new bond would amortize in three equal installments in 2029, 2030, and 2031, giving a weighted average tenure of six years.

The World Bank said Kenya’s government would have to be proactive in its liability management and focus on concessional borrowing to reduce its interest costs and amortization pressure, especially between 2028 and 2031, to forestall future liquidity squeezes.

In June, the government resorted to using part of the US$ 1.2 billion (Ksh 153,960,000,000) Development Policy Operations (DPO) loan approved by the World Bank Board to settle the remaining part of the Eurobond falling due on 24th June 2024.

The shilling has been on a bullish run with very high volatility at the initial stages from highs of Ksh 163 to lows of Ksh 127 in the last six months.

Additionally, interest rates on government securities have been sustainably high, with investors riding the tide whilst the government is keen on preventing locking in high borrowing costs over the long term.

Also Read: EABL Profit Declines After Shilling Devaluation

Other Currency Trends in Africa Countries

Traders have also predicted that Ugandan, Ghanaian, and Zambian currencies will remain broadly stable through next Thursday 19, while Nigeria’s may weaken.

However, they are concerned that Nigeria’s naira could lose ground amid rising foreign currency demand, despite the country successfully raising $900 million (Ksh 115,650,000,000) from a domestic dollar bond sale.

On Thursday, the naira was quoted at 1,650 to the dollar on the official market, a rate consistent with street trading figures. This marks a decline from around 1,592 naira a week earlier.

One trader pointed out that the dollar raise alone does not guarantee an appreciation of the naira, stating, “The dollar raise in itself does not translate to an appreciation until the central bank puts out those dollars to the market.”

He emphasized that current demand is overwhelming supply. While an increase in the central bank’s interventions in the currency market could bolster the naira, he noted that past interventions have been too small to make a significant impact.

Follow our WhatsApp Channel for real-time news updates!

https://whatsapp.com/channel/0029VaB3k54HltYFiQ1f2i2C

![Debate Rages Over Proposed Increase In Legal Drinking Age [Video] Nacada Raises Legal Drinking Age From 18 To 21]( https://thekenyatimescdn-ese7d3e7ghdnbfa9.z01.azurefd.net/prodimages/uploads/2025/07/beer-360x180.jpg)

![Debate Rages Over Proposed Increase In Legal Drinking Age [Video] Nacada Raises Legal Drinking Age From 18 To 21]( https://thekenyatimescdn-ese7d3e7ghdnbfa9.z01.azurefd.net/prodimages/uploads/2025/07/beer-120x86.jpg)