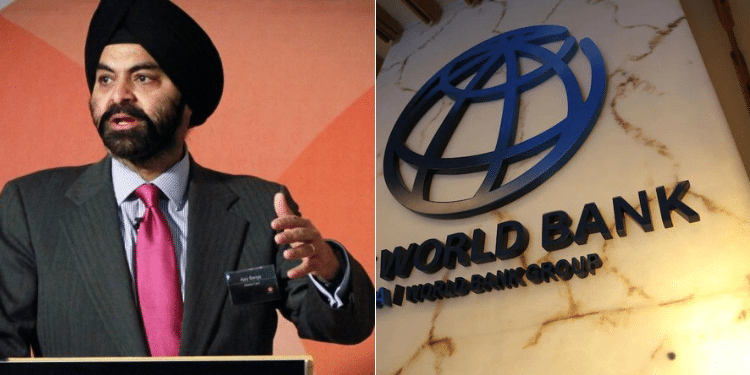

The World Bank will start publicizing confidential information including data on debt defaults from next week.

According to World Bank president Ajay Banga, the move is part of an effort to increase private sector investment in developing countries.

Speaking at the China Development Forum on March 24, Banga said World Bank Group mobilized $41 billion (Ksh5.4trillion) in private capital and generated $42 billion (Ksh5.5 trillion) in private funding for bond issuance for developing economies in 2023.

Banga explained that the Group expects to surpass both amounts in 2024, adding that economic growth has slowed in developing countries.

He noted that much is needed to uplift countries whose growth fell from 6% to 4% in two decades leading to rising debts and dragging people into poverty.

Banga said the Bank plans to remove the obstacles that prevented the private sector from investing in these nations.

The Bank will also publish private sector recovery data by country income level, private sector default data broken down by credit rating and sovereign default and recovery rate statistics dating back to 1985.

“All this work contributes to one goal: getting more private sector capital into developing economies to drive impact and create jobs,” Banga said.

Also Read: Kenya to Benefit from Ksh145 Billion World Bank Loan

Other Plans

The president also outlined the Bank’s initiative to establish a securitization platform to facilitate the flow of institutional investments into emerging markets.

He explained that the platform will streamline the investment process for pension funds and other institutional investors, aggregating large, standardized investments into cohesive packages to encourage substantial investment at scale.

Additionally, he revealed that there are 325 million expected job creation against 1.1 billion expected to enter the job market in the next decade in developing countries.

Banga praised China’s economic development revealing that the Asian Country, which was once a borrower, is currently one of the Bank’s biggest donors.

He said China has created hundreds of millions of jobs, reduced poverty and cut emissions in her economic transformation.

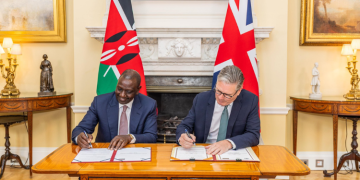

Also Read: Ruto Elated as World Bank Hands Kenya Kwanza Ksh1.2 Trillion Boost

Kenya World Bank Debt

According to the Central Bank of Kenya (CBK), Kenya’s debt from the World Bank stood at Ksh1.57 trillion ($10.45 billion) in June 2023.

The figure increased from Ksh1.46 trillion ($9.72 billion) at the end of May 2023 implying that close to 60 percent of Kenya’s total debts to multilateral lenders belonged to the World Bank.

National Treasury shows that Kenya paid Ksh32 billion to the International Development Association (IDA), and Ksh3.8 billion to the International Bank for Reconstruction and Development.

The Ksh35.8 billion was paid to the two World Bank subsidiaries between July and December 2023.