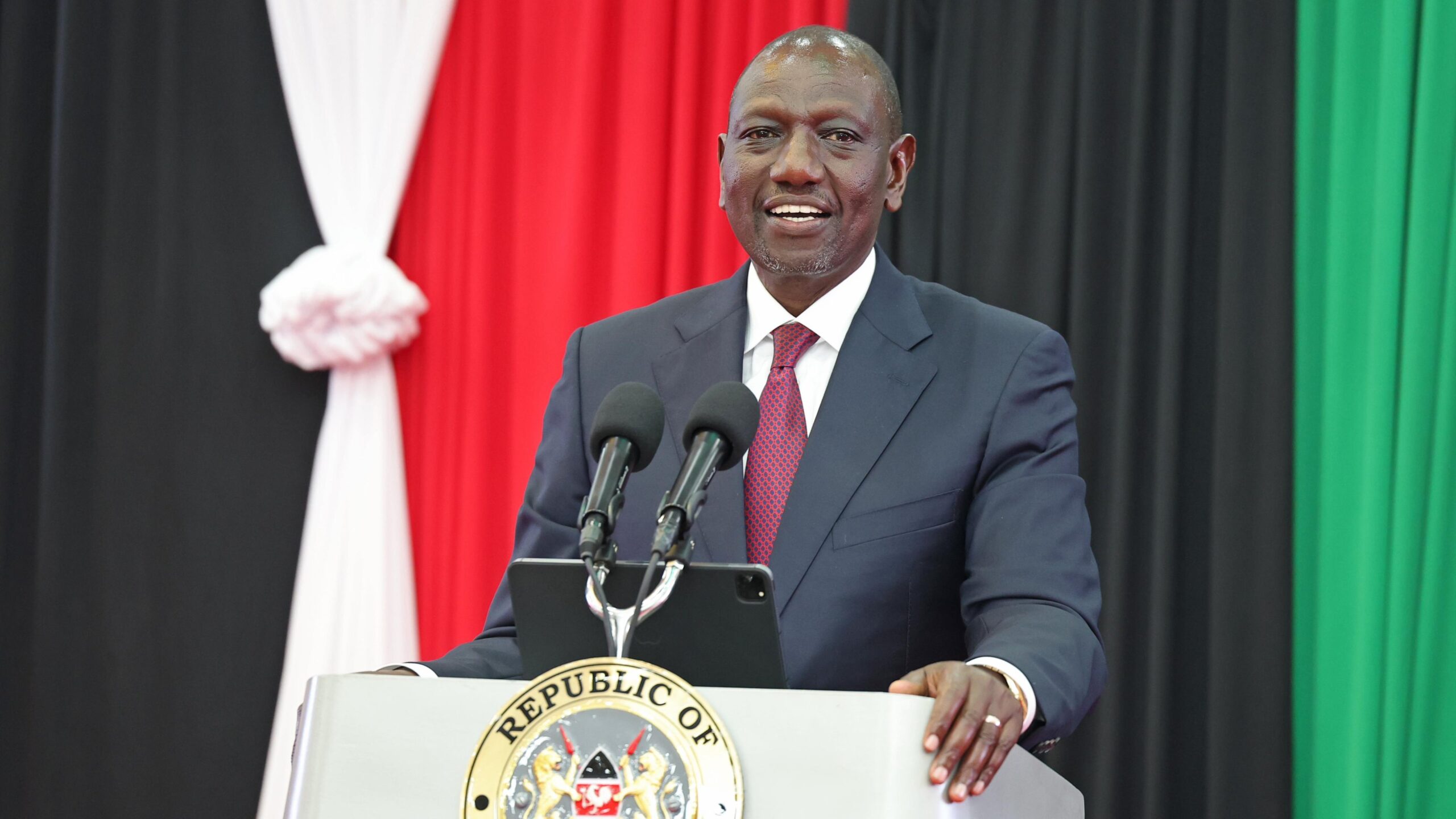

President William Ruto on Monday, September 11 launched the Central Securities Depository Dhow (DhowCSD), noting that interested traders will now buy government securities with ease.

During the event, the president asked the Central Bank of Kenya, CBK to work on making then government securities available to people in the diaspora.

According to Ruto, the government is keen on facilitating Kenyans to participate meaningfully in the building of the country.

“The development of DhowCSD cements the Government’s Plan to eliminate barriers to trade,” said President Ruto.

He further argued that “The development of DhowCSD cements the Government’s Plan to eliminate barriers to trade,” said President Ruto.

He therefore called for the democratization of the securities trading space so that the hustler could enjoy benefits of such investment vehicles.

CBK DhowCSD app

CBK will also be discontinuing manual bids for government securities as all bids will be done through the Dhow CSD portal.

Also Read: What You Need to Know About Kamau Thugge, CBK’s Next Boss

The CBK Dhow CSD is a new Central Securities Depository (CSD) that offers a simple, efficient, and secure portal by regulator to enable the public to invest in Government of Kenya securities.

“Dhow CSD will also improve the functioning of the interbank market by facilitating collaterised lending amongst commercial banks and further reduce segmentation in the interbank market” CBK said in a press release.

You can access the Dhow CSD on the CBK website.

If you already have a CSD account, your details will automatically be captured once you click on the “Already have a CSD account” button.

New traders can register by following the “Create Account” button and filling in the required information.

Also Read: CBK Launches QR Code Standard for Online Payments

The system has enabled an anywhere and anytime investment in Treasury Bills and Treasury Bonds, a move that will benefit investors interested in the securities.

Dhow CSD went live on Monday, July 31, 2023, and during the period since the launch, more than 7000 new accounts have been created, compared to the total of 44,000 that existed prior to the go live as noted by a press statement released by the CBK after the official launch.

What are government securities?

A government-issued bond is a form of investment that allows the government to borrow from the domestic market.

These funds are used to raise money on behalf of the Kenyan government, which are used to fund various projects such as building roads, hospitals and other government services.

CBK sells these products to finance day-to-day governmental operations and provide funding for special infrastructure and military projects.

Moreover, these securities will be available in two-year bonds and five-year bonds.

The interest rate for the 5-year bond will be 16.844% while the rates for the two-year bond will be determined through market bidding.

The treasury bills currently on offer are 91-day bills, 182-day bills and 364-day bills which will be auctioned on the 14th of September and will be dated from the 18th of September 2023.