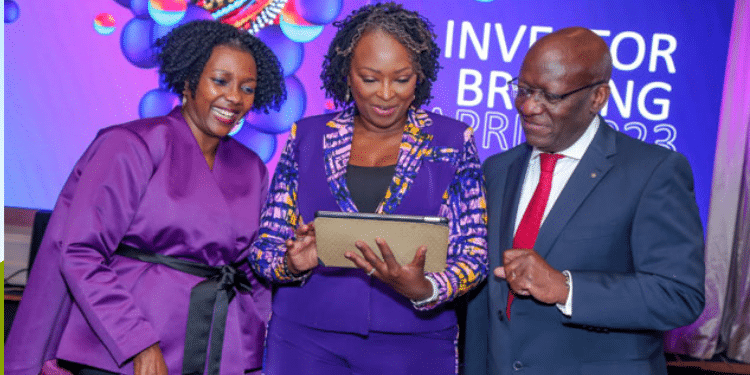

A tax expert has explained how Finance Bill 2024 will benefit investors in the telecommunications sector.

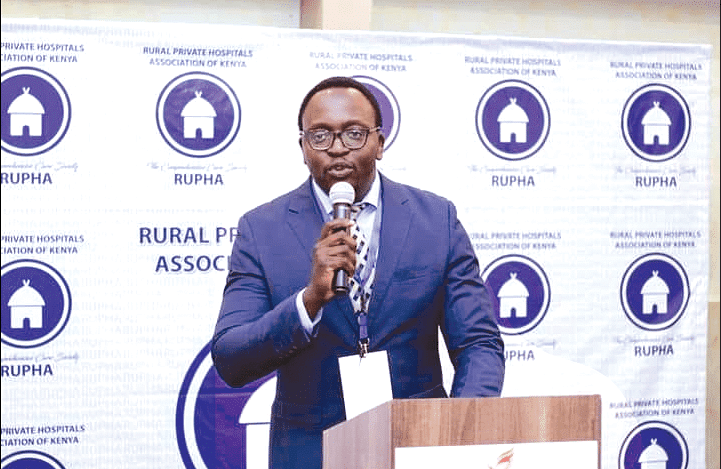

Speaking to The Kenya Times, Nicholas Kahiro, a Senior Tax Manager at PwC explained that the Bill is a win for telco sector investors based on capital expenditure on spectrum fees.

The bill seeks to amend the second schedule of the Income Tax Act to allow a tax deduction at the rate of 10% per year on capital expenditure incurred by telecommunications operators on acquisition of spectrum licenses.

“One of the key proposal contents in the Finance Bill 2024 is around investment allowance or you can call it capital allowance on spectrum license. The amendment will lead to a lower cost of providing telecommunication services in the country, and more so the 5G technology and other future advanced technologies,” he said.

Technological Growth

Kahiro explained that the amendment will also spur the growth of technology and innovation especially in the rural areas.

This is because telecommunication companies will incur lower costs in increasing their network coverage thereby making Kenya a technology hub.

“You will note that this is one of the significant costs incurred by most telecommunications companies whenever they are setting up or whenever they want to undertake their business. And with introduction of this capital allowance, it will reduce the cost of telecommunication services in Kenya and will spur growth as well as investment in the rural areas,” Kahiro added.

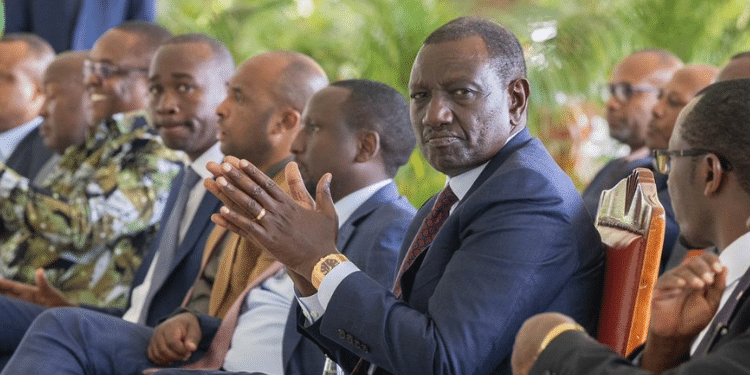

Besides, Kahiro explained that the amendment is in line with the current government’s technological advancement agenda under the digital superhighway and creative economy pillar.

“The government will want to establish Kenya as a leading state within the region in Internet connectivity,” he said.

Also Read: Kenyans Roast Karen Nyamu After Fumbling to Explain Finance Bill 2024

Finance Bill 2024 Proposals

The Finance Bill, 2024 was tabled on 13 May 2024 to the National Assembly for the first reading with significant proposals that will have an impact on businesses.

The National Treasury has followed through some of the revenue measures that they had outlined in the Medium-Term Revenue Strategy (MTRS).

MTRS was anchored on enhancing domestic revenue through introducing new taxes, increasing tax rates, and expanding the tax base with the aim of increasing Kenya’s tax collection to at least 20% of the GDP by the end of the financial year 2026/27.

Also Read: EABL Warns of Mass Layoffs in Kenya Over Proposed Finance Bill Taxes

The Bill proposes to amend the following Laws: Income Tax Act, CAP. 470 (ITA), Value Added Tax Act, CAP. 476 (VAT Act), Excise Duty Act, CAP. 472 and Tax Procedures Act CAP. 469B (TPA).

It also seeks to amend the Miscellaneous Fees and Levies Act CAP. 469C (“MFLA”), Affordable Housing Act, Industrial Training Act, CAP 237, Data Protection Act, CAP 411C, Public Finance Management Act, CAP 412A and Kenya Revenue Authority Act, CAP 469.

Follow our WhatsApp Channel for real-time news updates!

https://whatsapp.com/channel/0029VaB3k54HltYFiQ1f2i2C