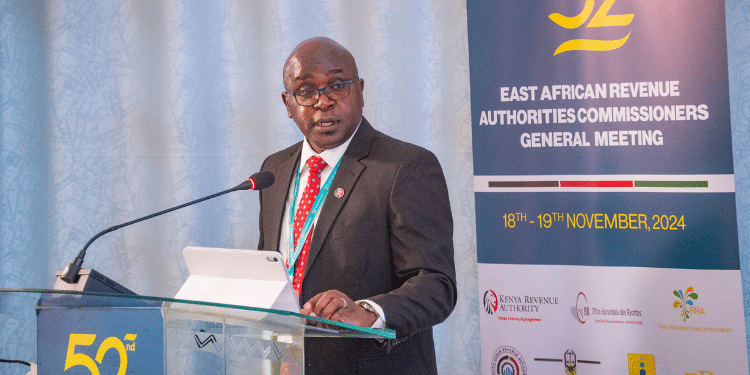

The Kenya Revenue Authority (KRA) has provided an update on changes to Pay As You Earn (PAYE) computation.

In a statement on December 19, 2024, KRA announced changes in calculation of PAYE effective December 27, 2024, under the Tax Laws (Amendment) Act, 2024.

KRA has now revealed that it is still in the process of implementing the changes.

“The recent amendments to the PAYE return are still in progress,” KRA said.

However, KRA stated that the PAYE return still allows any employer who has provided the allowable deductions to their employees in the payroll, to capture the correct PAYE deducted under the self-assessed PAYE column and file the PAYE return with the correct liabilities.

In the earlier announcement, KRA said the changes will be applicable in the computation of PAYE for December 2024 and subsequent periods.

The changes will impact deductible contributions, such as the Housing Levy, Social Health Insurance Fund (SHIF), post-retirement medical funds, tax reliefs, and employment gains and profits.

KRA announced that Affordable Housing Tax Relief and Post-Retirement Medical Fund Relief will no longer apply.

Also Read: Win for Kenyans as KRA Announces Tax Amnesty [How to Qualify]

KRA PAYE Changes

Under the changes, the following amounts will be deductible when calculating taxable employment income:

- Amount deducted as Affordable Housing Levy pursuant to the Affordable Housing Act, 2024.

- Contribution to a post-retirement medical fund subject to a limit of Ksh15,000 per month.

- Contributions made to the Social Health Insurance Fund (SHIF).

- Mortgage interest, not exceeding Ksh360.000 per year (Ksh30,000 per month), upon money borrowed by a person from one of the first six financial institutions specified in the Fourth Schedule to the Income Tax Act, to purchase or improve premises occupied by the person for residential purposes.

- Contribution made to a registered pension or provident fund or a registered individual retirement fund up to a limit of Ksh360,000 per year (Ksh30,000 per month).

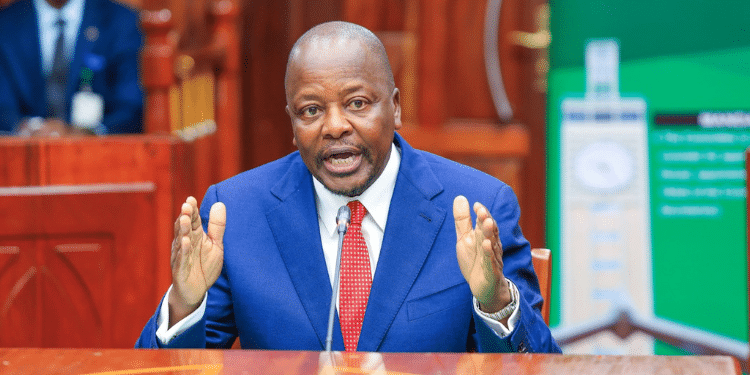

Also Read: KRA Chair Ndiritu Muriithi Announces Plans to Extend Tax Amnesty, Waiving Penalties & Interest for Kenyans

What Does Not Constitute Gains and Profits from Employment

KRA explained that gains and profits from employment shall not include:

- The value of a benefit, advantage, or facility granted in respect of employment, where the aggregate value is less than Kshs. 60,000 per year (Ksh5,000 per month).

- The first Ksh60.000 per year (Ksh5,000 per month) on the value of meals provided by an employer.

- An amount not exceeding Ksh360.000 paid by an employer as a gratuity or similar payment in respect of employment or services rendered for each year of service paid into a registered retirement pension scheme.

Follow our WhatsApp Channel and join our WhatsApp Group for real-time news updates.