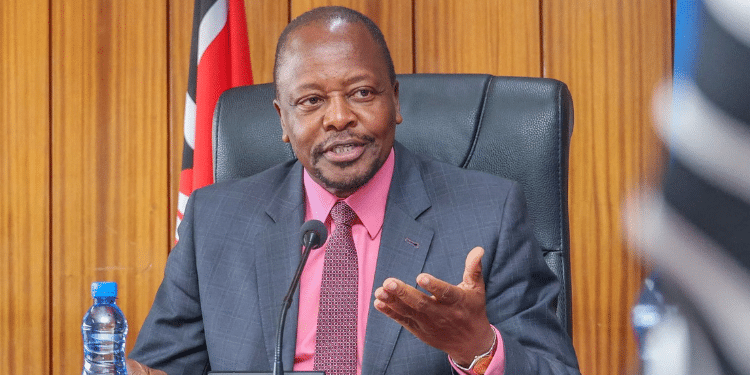

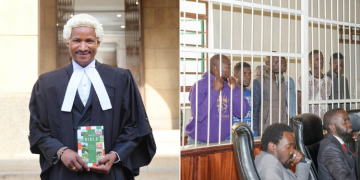

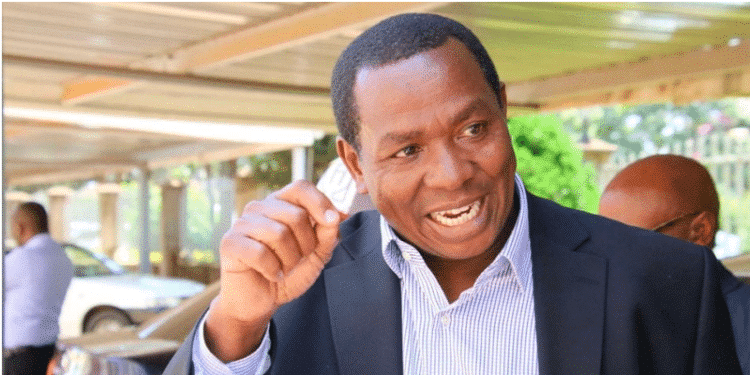

Newly Appointed Kenya Revenue Authority (KRA) Chairman and former Laikipia Governor, Ndiritu Muriithi has affirmed the KRA Board’s commitment to transforming the Tax Authority into a professional, fair and service-oriented organization.

Speaking during his swearing-in ceremony on Monday, December 30, at the Supreme Court Building in Nairobi, Ndiritu vowed to extend the tax amnesty program, that has waived all penalties and interests for all periods up to 31st December 2023.

“Among key initiatives that I’m keen to progress is the extended tax amnesty program, which has waived all penalties and interests for all periods up to 31st December 2023,” Ndiritu said.

“The amnesty was effected on 27th December 2024 and will end on 30th June 2024.”

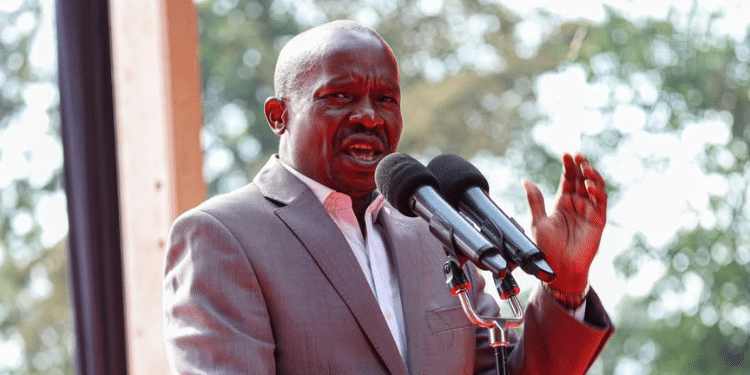

New KRA Chair Ndiritu Muriithi on Tax Amnesty

Ndiritu mentioned that the amnesty program first rolled out in the previous financial year 2023/2024, saw a waiver of over 200 billion shillings in penalties, and enabled the collection of 50.5 billion shillings in taxes.

“I want to encourage all taxpayers, whether individual, businesses or corporations to take advantage of the amnesty at the earliest and enjoy the relief it brings with regards to taxation,” he added.

Also Read: Win for Kenyans as KRA Announces Tax Amnesty [How to Qualify]

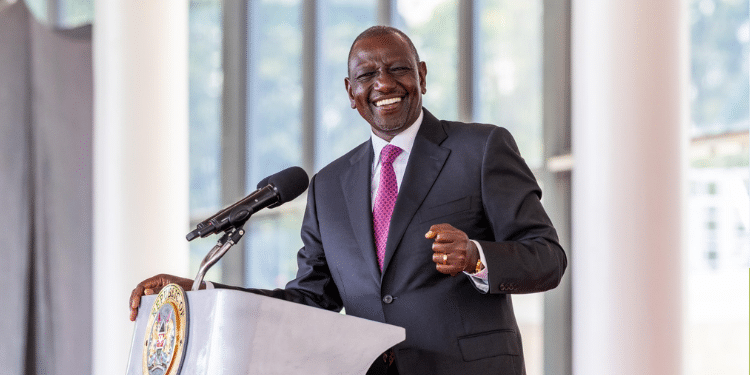

Furthermore, Ndiritu mentioned that his vision is to steer KRA to become a more professional, fair, yet firm organization guided by the core values; thus, Trustworthy, Ethical, Competent, Helpful, Innovative and Simple.

“Together with Members of the Board of Directors, our endeavour will be to ensure KRA achieves its full potential by providing sound Governance, oversight and accountability,” the new KRA chair said.

He added, “We will also continue to build strategic partnerships with our stakeholders in the public and private sector, to develop sector-specific, responsive solutions and programs for our taxpayers; to collectively build and boost the economy of our Country.”

Ndiritu further pledged KRA’s commitment to leverage technology and ensure that its systems are fit for purposes, user friendly and easily accessible in order to make it more convenient for all taxpayers to comply with their tax obligations.

Also Read: KRA Announces Changes in Calculation of Monthly Taxes

About the Tax Amnesty Program

KRA’s tax amnesty program offers taxpayers the chance to apply for a waiver on penalties and interest accrued on outstanding taxes up to December 31, 2023.

To qualify, taxpayers who have not paid all the principal taxes by the end of 2023 and cannot make a lump sum payment must fully settle their principal taxes by June 30, 2025.

Additionally, they must apply to the KRA Commissioner for amnesty and propose a payment plan for any outstanding principal taxes.

In August 2024, KRA reported collecting Ksh 43.9 billion from 1,064,667 taxpayers under this program, which ended on June 30, 2024.

The authority also announced that the waived penalties and interest amounted to Ksh 507.7 billion between September 2023 and June 30, 2024.

Follow our WhatsApp Channel and join our WhatsApp Group for real-time news updates.

![Debate Rages Over Proposed Increase In Legal Drinking Age [Video] Nacada Raises Legal Drinking Age From 18 To 21]( https://thekenyatimescdn-ese7d3e7ghdnbfa9.z01.azurefd.net/prodimages/uploads/2025/07/beer-360x180.jpg)

![Debate Rages Over Proposed Increase In Legal Drinking Age [Video] Nacada Raises Legal Drinking Age From 18 To 21]( https://thekenyatimescdn-ese7d3e7ghdnbfa9.z01.azurefd.net/prodimages/uploads/2025/07/beer-120x86.jpg)