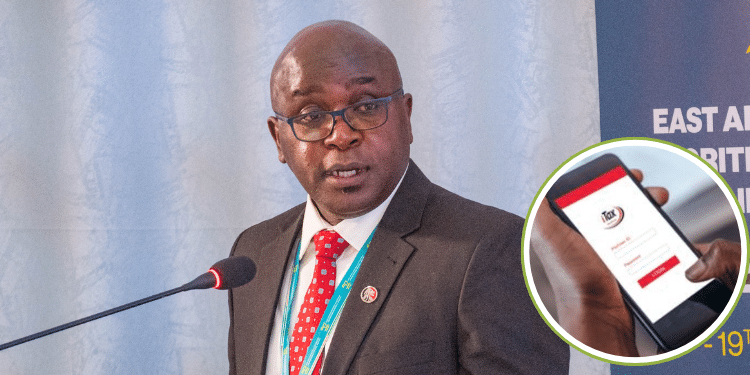

The Kenya Revenue Authority (KRA) has announced the return of the Tax Amnesty Program after the enactment of the Tax Procedures (Amendment) Act, 2024.

KRA in a notice on Friday, December 27, 2024, said that the Tax Amnesty Program is set to continue after President William Ruto assented the Tax Procedures (Amendment) Act, 2024 to law.

The amnesty program commences on the notice date and is set to conclude on June 30, 2025.

It will offer taxpayers the opportunity to apply for the waiver of penalties and interest accrued on outstanding taxes up to December 31, 2023.

“The Kenya Revenue Authority (KRA) informs taxpayers that the Tax Procedures (Amendment) Act, 2024 has introduced a tax amnesty on interest, penalties or fines on tax debt for periods up to 31st December 2023. The tax amnesty program will run from 27th December 2024 to 30th June 2025,” the notice reads in part.

How to apply for the KRA Tax Amnesty Program

To qualify for the amnesty, taxpayers who have not paid all the principal taxes accrued up to December 31, 2023, and are unable to make a one-off payment for the outstanding principal taxes are required to fully settle their principal taxes by the stipulated deadline of June 30, 2025.

Also Read: KRA Announces Changes in Calculation of Monthly Taxes

In addition, they will be required to apply to the KRA Commissioner for the amnesty and propose a payment plan for any outstanding principal taxes.

“A person who has paid all the principal taxes that were due by 31st December 2023 will be entitled to automatic waiver of the penalties and interest related to that period and will not be required to make an amnesty application. Taxpayers are encouraged to take advantage of this opportunity to clear outstanding tax liabilities,” the statement adds.

The tax amnesty program was introduced by the Finance Act 2023, allowing taxpayers to apply for amnesty of penalties and interests on tax debt for periods up to December 31, 2022.

This followed the repeal of the provisions on abandonment and waivers of penalties and interest.

Under the Tax Amnesty Program, taxpayers are only required to pay the principal tax amount of their outstanding tax debts.

Billions collected under Amnesty Program

In August this year, KRA announced that it collected Ksh43.9 billion from 1,064,667 taxpayers under the program that ended on June 30, 2024.

Also Read: KRA Announces Changes to VAT Return Filing Process

The authority said waived penalties and interest amounted to Ksh507.7 billion between September 2023 and June 30, 2024.

Further, it noted that the program was successful in the month of June 2024 when it recorded the highest collection of Ksh15.1 billion.

“Through the tax amnesty program, KRA waived penalties and interest amounting to Ksh507.7 billion benefiting 3,115,393 taxpayers between 1st September 2023 and 30th June 2024,” the statement read in part.

“The waivers include those that were offered automatically after taxpayers filed their returns, declared and paid their principal taxes.”

Follow our WhatsApp Channel and join our WhatsApp Group for real-time news updates.