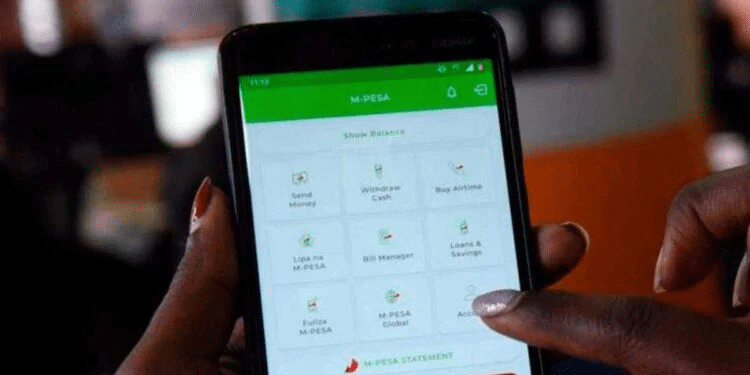

Fuliza is a popular service by Safaricom that allows M-PESA users to complete transactions even when they have insufficient funds in their M-PESA account.

To use the service, one must be a registered M-PESA user with an active Safaricom line. Customers can dial *334# and select “Fuliza M-PESA” to opt in.

Safaricom treats each M-Pesa-registered line as a separate Fuliza account with its limit, which is reviewed every three months based on usage patterns.

Moreover, users can check their Fuliza limit, balance, mini statement, and opt-out options by dialing *334# and selecting Fuliza M-PESA.

Although Fuliza offers financial flexibility, it can also restrict access under certain conditions.

Also Read: How to Unlock, Reset Forgotten or Blocked M-PESA PIN

Here is a breakdown of when and why Fuliza may block customers from borrowing:

1. Unpaid Fuliza Balances After 30 Days

One of the most common reasons for being blocked from using Fuliza is failing to repay the borrowed amount within 30 days.

After the 30-day period, the Fuliza limit is temporarily suspended until the full outstanding balance is cleared.

This ensures that the service is used responsibly and that customers do not accumulate unmanageable debt.

2. Failure to Repay at All

Timely repayment is crucial.

If a customer consistently fails to repay their Fuliza loan, the service remains inaccessible.

Such defaults may also affect access to other digital credit products and mobile loan services in Kenya.

3. Credit Reference Bureau (CRB) Listing

If the outstanding Fuliza balance is not cleared within 120 days, Safaricom may forward the customer’s details to a CRB.

Being listed negatively impacts a customer’s credit score and limits access to formal credit facilities like bank loans and digital lending platforms.

4. Exceeding the Fuliza Limit

Fuliza users can only borrow within their allocated limit.

If this limit is exhausted, the service will automatically block further transactions until partial or full repayment is made to restore some of the limit.

Also Read: How to Increase Fuliza Limit for Safaricom Users

5. M-PESA Transaction Limits

Even if a user has an available Fuliza limit, their transaction may be blocked if it causes them to exceed the daily M-PESA transaction limit.

Fuliza works within the boundaries of M-PESA regulations.

6. Lost SIM Cards or Suspected Unauthorized Access

In the event of a lost SIM or suspected fraudulent activity, Safaricom may block Fuliza temporarily to protect the customer.

Customers are advised to report such issues immediately to avoid misuse.

7. Fraudulent Activity and Misuse

Some individuals try to game the system by registering multiple SIM cards under the same ID and defaulting on Fuliza loans.

Safaricom tracks such activity and may permanently block the affected lines and take legal action.

NEW Structured FULIZA Tariff

| Tariff Band | Old Daily Maintenance Fee | New Daily Maintenance Fee |

|---|---|---|

| 1–100 | 0.00 | 0.00 |

| 101–500 | 5.00 | Free for first 3 days, 2.50 after |

| 501–1000 | 10.00 | Free for first 3 days, 5.00 after |

| 1001–1500 | 20.00 | 18.00 |

| 1501–2500 | 25.00 | 20.00 |

| 2501–70000 | 30.00 | 25.00 |

Follow our WhatsApp Channel and X Account for real-time news updates.

![Nema Closes Emirates Lounge, Bar Next Door And 6 Other Popular Nightlife Clubs [List] Ruto Announces Hiring Of 24,000 Teachers By January 2026](https://cdn.thekenyatimes.com/uploads/2025/11/nairobi-360x180.png)

Safaricom the better option, your surface is the best ever