Choosing a bank in Kenya is more than just walking into the nearest branch or going with the one your employer uses. With over 40 licensed commercial banks and a rapidly digitizing financial landscape, picking the right bank—and the right type of account—can significantly impact how you manage, grow, and protect your money.

Whether you’re opening your first account, switching banks, or looking to expand your financial portfolio, this guide breaks down what to look for, how banks operate and earn money, and why having both a current and savings account can be a smart move.

How Banks Operate and Make Money

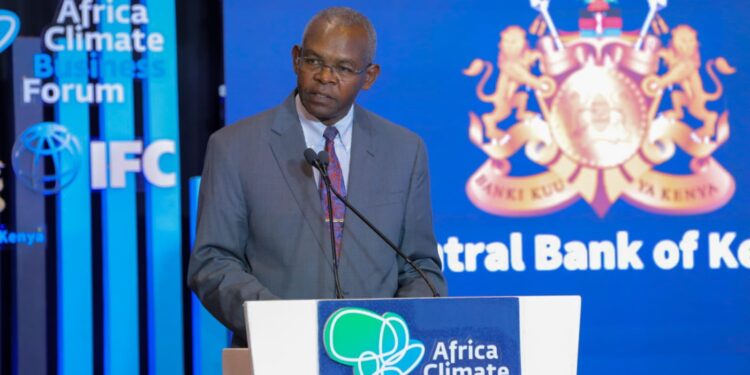

Banks are financial institutions licensed by the Central Bank of Kenya (CBK) to accept deposits, lend money, and offer other financial services. While they provide a safe place to keep your money and facilitate transactions, banks are also businesses aiming to make a profit.

Here’s how banks typically make money:

- Interest on Loans: Banks lend out a portion of customer deposits at higher interest rates than they pay depositors.

- Fees and Charges: These include maintenance fees, ATM fees, mobile banking charges, overdraft fees, and foreign transaction charges.

- Investments: Banks invest in treasury bills, government securities, and other instruments for income.

- Value-added Services: Insurance, forex trading, bancassurance, and advisory services also generate revenue.

Understanding this helps you be alert to hidden charges and value for money in the services offered.

What to Look for When Choosing a Bank

Not all banks are created equal. Some are best for convenience, others for low fees, digital innovation, or business banking. Here’s what to consider:

- Licensing and Reputation

- Ensure the bank is licensed by the CBK and regulated under the Banking Act.

- Check its financial stability, reputation, and track record through CBK’s Bank Supervision Annual Reports or customer reviews.

- Fees and Charges

- Compare account maintenance fees, transaction charges, ATM and mobile banking costs, and loan processing fees.

- Some banks offer zero monthly fees for digital accounts or youth/students, while others charge hidden levies.

- Accessibility

- Does the bank have branches and ATMs near you?

- Do they offer robust mobile banking, USSD, or online banking?

- How responsive is their customer service?

- Product Range

- What types of accounts do they offer? Savings, current, youth, fixed deposit, diaspora, or foreign currency?

- Are you also interested in loans, mortgages, or business banking? Choose a bank with diverse and flexible products.

- Interest Rates

- Compare interest earned on savings and fixed deposits, and interest charged on loans and overdrafts.

- Ask about annual percentage yield (APY) for savings and annual percentage rate (APR) for loans.

- Digital Experience

- Is the mobile app user-friendly?

- Can you pay bills, transfer funds, access mini-statements, or block your card remotely?

- Customer Service

- Look for banks with 24/7 customer care, in-branch support, and active social media engagement.

- Ask about complaint resolution timelines and accessibility of relationship managers.

Also Read: How and Why Kenyan Banks Are Consistently Making Profits

Choosing the Right Bank Account for Your Needs

Banks offer various types of accounts, each tailored to specific purposes. The key is selecting an account that fits your financial lifestyle.

- Current Account

Best for: Frequent transactions, salary processing, and business payments

- No interest earned

- Unlimited deposits and withdrawals

- Ideal for individuals with regular cash flows or business operations

- Savings Account

Best for: Building a savings habit and earning interest

- Limited monthly withdrawals (usually 3–6 free per month)

- Interest on deposits (ranges from 3%–7% p.a. depending on bank)

- May have restrictions to encourage saving

- Fixed Deposit Account

Best for: Earning higher interest on money you don’t need to access for a while

- Fixed terms from 1 month to 1 year or more

- Higher interest rates than savings accounts

- Penalties for early withdrawal

- Digital or Mobile-Only Account

Best for: Tech-savvy individuals seeking low-cost banking

- Often have no monthly fees

- Easy account opening via phone or app

- Limited in-person services

- Youth or Student Account

Best for: Students and young people under 25

- Minimal or zero fees

- Encourages saving and financial literacy

- May offer parental control features

Checklist for Choosing the Right Bank in Kenya

- Licensing & Trust

- Is the bank licensed by the Central Bank of Kenya (CBK)?

- Does the bank have a solid reputation and good reviews?

- Has the bank been operational for several years?

- Fees & Charges

- What are the monthly maintenance fees?

- Are there ATM withdrawal charges or limits?

- Does the mobile banking platform charge per transaction?

- Any hidden fees (e.g. SMS, over-the-counter withdrawals)?

- Accessibility

- Are there branches or ATMs near you?

- Is the mobile app or USSD platform reliable?

- Do they offer online customer support or 24/7 help lines?

- Digital Experience

- Is the mobile app/user interface easy to use?

- Can you:

- Transfer money easily?

- Pay bills and buy airtime?

- Access statements or balances instantly?

- Are digital services secure (e.g., OTP, biometric login)?

- Account Options

- Does the bank offer the type of account you need?

- Current Account

- Savings Account

- Youth/Student Account

- Fixed Deposit Account

- Business/SME Account

- Can you open the account online or must you visit a branch?

- Interest & Earnings

- What is the interest rate on savings or fixed deposits?

- Are interests compounded monthly or annually?

- Is the interest taxed (usually 15%)?

- Loans & Credit Options

- Does the bank offer affordable loans or credit facilities?

- What is the loan interest rate (APR)?

- Are there any hidden costs (processing fees, insurance)?

- Is there a grace period or flexible repayment plan?

Customer Service

- How quickly does the bank respond to issues?

- Is the staff helpful and knowledgeable?

- Do they offer a dedicated relationship manager?

- Additional Services

- Do they offer:

- Group/Chama accounts?

- Diaspora services?

- Investment or insurance products?

- Forex and international transfers?

Also Read: CBK Reveals Banks with Lowest and Highest Loan Interest Rates as of February 2025

- Strategic Fit

- Does the bank suit your daily lifestyle (e.g. mobile-first vs. branch-based)?

- Does it support your long-term goals (e.g. home loan, business, school fees)?

- Can you pair it with a savings account for better money management?

Should You Always Open a Savings Account in Addition to a Current Account?

Yes—and here’s why:

| Benefit | Reason |

| Discipline | Keeps savings separate from daily spending |

| Interest | Savings accounts typically earn interest; current accounts don’t |

| Emergency Fund | Acts as a cushion for unexpected expenses |

| Loan Qualification | Banks often evaluate your savings behavior when assessing loan eligibility |

| Budgeting | Easier to track goals like school fees, investments, or travel when savings are separate |

Even if you open a current account for daily use, pairing it with a savings account creates a structured financial strategy.

Top Banks to Consider in Kenya (2024 Overview)

| Bank | Strengths |

| Equity Bank | Widespread reach, mobile innovation (Equitel), great for small businesses |

| KCB Bank | Large asset base, good for mortgages and diaspora services |

| Co-operative Bank | Strong SACCO relationships, reliable for farmers and groups |

| ABSA Kenya | Excellent digital platforms, premium services |

| NCBA | Known for M-Shwari and Loop—mobile-first options |

| Stanbic and Standard Chartered | Great for professionals, high net worth and expatriates |

| Family Bank | Community-focused, flexible loan products |

| DTB Kenya | Competitive for trade finance and Islamic banking |

Final Thoughts

Choosing the right bank in Kenya is about alignment with your goals, values, and lifestyle. The best bank for you may not be the largest—it’s the one that fits your financial behavior and empowers you to grow your money with minimal stress.

Pro Tip: Review your banking needs at least once a year. Don’t be afraid to switch banks if your current one no longer serves your goals.

Follow our WhatsApp Channel and X Account for real-time news updates.