The Central Bank of Kenya (CBK) on Tuesday, February 6, raised the borrowing rate for banks to 13% from the previous 12.5%.

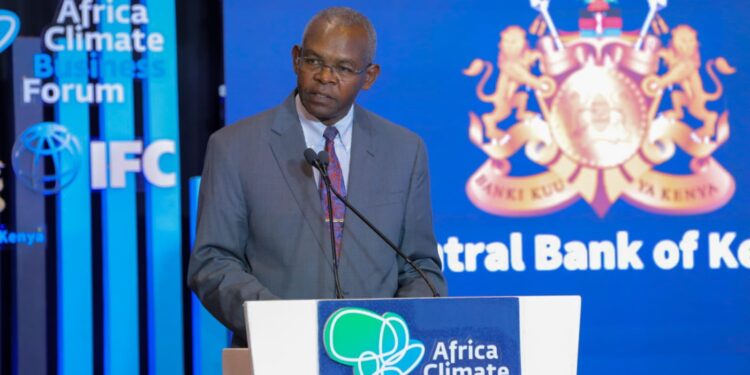

In a statement, CBK announced the move after a Monetary Policy Committee (MPC) meeting led by Governor Kamau Thugge.

According to the statement, the MPC observed that the rate of inflation was still high and thus the need to address it.

The Committee also noted that key components of inflation including fuel and food had increased in the month of January.

Therefore, the trends, coupled with the pressures on the exchange rate, led to the committee’s conclusion that there was a need to raise the lending rates.

“The MPC noted that overall inflation has remained sticky in the upper bound of the target range;” the CBK statement read in part.

“In addition, the MPC noted the continued, albeit reduced, pressures on the exchange rate and therefore concluded that further action was needed to stabilize prices.”

Once effected, CBK notes, the new borrowing rate will help to lower the rate of inflation towards its target of 5.0 per cent.

“The proposed action will ensure that inflationary expectations remain anchored, while setting inflation on a firm downward path towards the 5.0 percent mid-point of the target range, as well as addressing residual pressures on the exchange rate,” CBK added.

The MPC therefore decided to raise the Central Bank Rate (CBR) from 12.50 percent to 13.00 percent.

Also Read: More Pain as CBK Hikes Loan Interest Rates to Record High

CBK’s new borrowing rates for banks is the highest the country has seen for over 11 years.

CBK gives analysis of inflation trend in January

According to the observations captured in CBK’s statement, Kenya’s overall inflation was in the region of 6.9% in January, up from the 6.5% in December 2023.

In particular, food inflation increased to 7.9% in January 2024 compared to the 7.7% in December 2023, with the prices of non-vegetable items increasing.

At the same time, fuel prices increased despite the reduced prices of petroleum products in the January-February cycle.

According to the statement, the inflation on fuel products was attributed to the increase in electricity tariffs.

Also Read: Companies Slash Production as Kenyans Slow Down on Buying

The Central Bank also announced that surveys conducted by the Monetary Policy Committee (MPC) showed that CEOs in Kenya were optimistic of increased business activity and economic growth in the year ahead.

Respondents in the survey, the bank added, said improvement in the agricultural sector and the easing global inflation were among the factors driving their optimism.

However, the CEOs expressed their concerns about the weakening Kenyan Shilling and increasing lending rates.