The High Court has declared that the Higher Education Loans Board (HELB) cannot demand more than double the principal amount borrowed by beneficiaries.

The ruling delivered by Justice A. Mabeya following a petition has major implications for thousands of Kenyans who have struggled to repay loans due to accumulating interest and penalties.

Three former students in the petition argued that HELB had imposed excessive interest and penalties, resulting in their loans growing beyond manageable levels. One borrower had taken a HELB loan of Ksh82,000, but accumulated interest and penalties pushed the amount to several times the principal.

The petitioners argued that this violated their constitutional rights, especially their socio-economic rights and consumer rights under Articles 43 and 46 of the Constitution.

Court rules that the duplum rule applies not just to banks

HELB had claimed that the in duplum rule-a legal principle that stops interest from accumulating after it equals the principal-applied only to commercial banks under Section 44A of the Banking Act.

However, the Court disagreed. Justice Mabeya ruled that the in duplum rule is grounded in public interest and therefore applies to all lenders, including statutory bodies such as HELB. He noted that the rule was introduced to protect borrowers from unending interest accumulation and to ensure fairness in lending.

According to the judgment, once a HELB loan’s interest and penalties equal the original loan amount, no further interest or penalties may be charged.

The Court also found that HELB’s practice of allowing interest and penalties to exceed the principal amount discriminated against its borrowers. It pointed out that borrowers in the banking sector are protected by the in duplum rule, yet HELB borrowers, most of whom are students from financially challenged backgrounds, had no such protection.

Justice Mabeya ruled that this disparity violated Article 27 of the Constitution, which guarantees equality and non-discrimination.

“Their socio-economic rights under articles 43(1)(e) and (f) and consumer rights under article 46(1) (c) of the Constitution had been violated. That had the counter-effect of making it difficult for the petitioners and others in the same situation to conveniently repay the loan. The petitioner’s case did not challenge the State in the action it had taken, but rather sought the aid of the court to give effect to those measures.”

HELB Act must be interpreted to include the in duplum rule

Although the Court did not strike down Section 15(2) of the HELB Act, which provides for penalties, it ruled that the section must be read together with the in duplum rule.

This means HELB may impose fines and interest-but only up to the point where the total reaches double the principal. All further interest and fines must stop beyond that point.

Also Read: Court of Appeal Scraps Three-Year Waiting Period for Divorce in Kenya

The Court noted that many students finish school without immediately securing jobs, making it difficult to repay their loans quickly. Allowing interest and fines to compound indefinitely, it said, was unfair and contrary to the purpose of the HELB fund.

The Court emphasized that borrowers must still repay what they owe-but only within the legal limits set by the in duplum rule.

Justice Mabeya allowed the petition and ruled that each party bear its own costs. The ruling offers clarity and relief for many HELB beneficiaries who have struggled under significant penalties, some of which have ballooned their loans to unmanageable amounts.

Over 380,000 defaulters

HELB provides loans, bursaries, and scholarships to students in higher education. It operates on a revolving fund model, meaning repayments from past beneficiaries are used to fund current students.

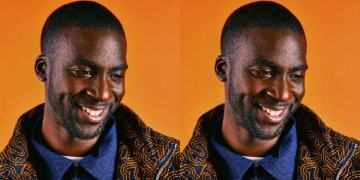

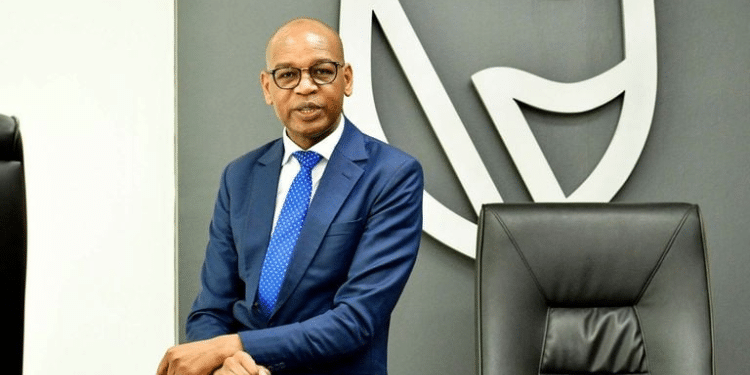

CEO Geoffrey Monari had issued strong statements in September and October this year regarding the increasing number of loan defaulters, emphasizing the need for repayment the sustain the fund. According to him, there are over 380,000 defaulters who collectively owe Ksh42 billion.

Also Read: HELB Announces 80% Penalty Waiver for Loan Defaulters

Monari has highlighted that a significant number of the country’s most educated professionals, including lawyers, accountants, doctors, and engineers, are among the worst culprits, despite many being gainfully employed. Teachers are noted as the most diligent in repaying their loans.

HELB is intensifying its loan recovery efforts with over 120,000 defaulters already listed with Credit Reference Bureaus (CRB). The board is also pursuing legal reforms to gain authority to freeze bank accounts of those able but unwilling to pay.

Follow our WhatsApp Channel and X Account for real-time news updates.

![List Of Hospitals Per County Offering Inpatient And Maternity Care For Teachers Under Sha [Full List] Teachers Meeting President William Ruto At State House. Photo/Pcs](https://cdn.thekenyatimes.com/2025/12/teachers-2025.webp)

![New Report Reveals Top 10 Most Trusted Brands In Kenya [List] Glass House Pr Ceo Mary Njoki. Photo/Google](https://cdn.thekenyatimes.com/2025/12/CEO-mary.png)

![Nema Closes Emirates Lounge, Bar Next Door And 6 Other Popular Nightlife Clubs [List] Ruto Announces Hiring Of 24,000 Teachers By January 2026](https://cdn.thekenyatimes.com/uploads/2025/11/nairobi-360x180.png)