The Competition Authority of Kenya (CAK) has imposed a KSh 85 million penalty on Directline Assurance Company Limited for abusing buyer power against two small and medium-sized enterprises (SMEs) operating as motor vehicle repair garages.

The sanction follows investigations into delayed payments and unfair contractual practices that violated provisions of the Competition Act.

In a public press release dated December 3, CAK stated that Directline leveraged its superior bargaining position to delay payments owed to Kilele Motors Limited and Midland Autocare Limited, two Nairobi-based garages contracted to repair insured vehicles, offering services such as panel beating, spray painting, and mechanical repairs.

The insurer reportedly owed Kilele Ksh 7.6 million and Midland Ksh 5 million for services rendered in 2023 and 2024.

Stone Cold from Directline Assurance

CAK stated that despite repeated reminders, the payments remained outstanding, leaving the SMEs in financial distress.

CAK explained that when an insured motor vehicle is damaged, the insurer commissions an assessment and, thereafter, engages a garage to repair it to the client’s satisfaction.

The authority added that insurance firms maintain a panel of assessors and garage owners on a contractual basis.

In 2023 and 2024, Kilele and Midland were contracted by Directline as motor vehicle repairers.

In May 2024, Kilele and Midland lodged separate complaints with the Authority, alleging that the insurer had failed to honor its invoices despite satisfactorily undertaking several repair assignments, without justifiable reasons and in breach of agreed payment terms.

“The two firms supplied the Authority with evidentiary information to support their allegations, including authorization letters, re-inspection reports, invoices, release letters, customer satisfaction notes and correspondence between the parties regarding the pending payments,” read part of the CAK statement.

“Directline justified its conduct, claiming the delay in processing the payments was occasioned by the temporary inaccessibility of its bank accounts. The insurer stated it understood the importance of making timely payments, adding that it had made progress in settling the outstanding amount and committed to clearing it.”

The Authority determined that Directline’s conduct breached Section 24A of the Competition Act and the Buyer Power Guidelines, 2022.

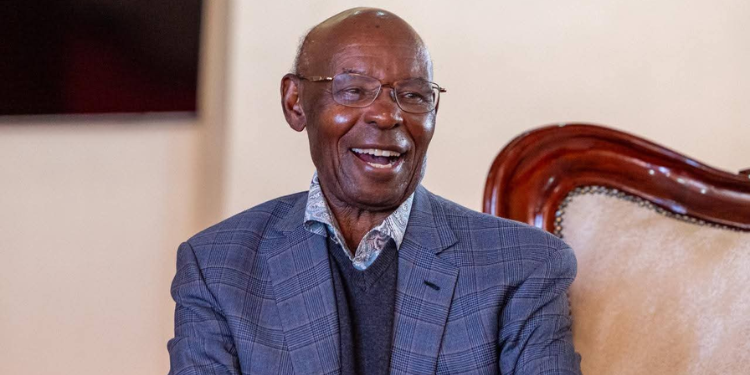

“Abuse of buyer power cripples suppliers and undermines inclusive economic development. SMEs are liquidity-constrained enterprises. Failure to honor payments for work done can destroy a business and render thousands jobless,” said CAK Director-General David Kemei.

Kemei pointed out that the penalty serves as a stern warning to firms exploiting their market position to the disadvantage of smaller businesses.

Justice Served

The insurer, licensed under the Insurance Act, Cap. 487, operates 24 branches nationwide and offers a range of motor vehicle insurance products.

Also Read: How Teachers Are Enjoying Superior Benefits to Other Public Servants Under New SHA Package

However, CAK noted that its failure to meet contractual obligations left the garages in a very difficult financial position, limiting their ability to pay employees, suppliers, and landlords, or to invest in business growth.

“The penalties levied are commensurate with the gravity of the offence and the conduct of the accused during the investigation. Supply contracts between parties to a commercial relationship should be equitable and the product of candid engagements,” Kemei added.

Beyond the financial penalty, CAK has ordered Directline to revise its supply contracts to include interest on late payments and ensure transparency in future engagements.

Kemei stated that CAK will monitor implementation and may conduct follow-up audits to confirm compliance.

The Authority has urged other insurers to review their practices proactively to avoid similar sanctions.

Also Read: Kenyan Students in Finland Forced to Collect Empty Bottles to Buy Food

Directline has also been directed to desist from engaging in practices that violate the Competition Act.

CAK reiterated its commitment to safeguarding SMEs from unfair treatment and promoting a competitive marketplace that supports economic resilience.

For inquiries, CAK advised stakeholders to contact its Communications and External Relations office via its official portal or WhatsApp channel.

Follow our WhatsApp Channel and X Account for real-time news updates.

![New Report Reveals Top 10 Most Trusted Brands In Kenya [List] Glass House Pr Ceo Mary Njoki. Photo/Google](https://cdn.thekenyatimes.com/2025/12/CEO-mary.png)

![Nema Closes Emirates Lounge, Bar Next Door And 6 Other Popular Nightlife Clubs [List] Ruto Announces Hiring Of 24,000 Teachers By January 2026](https://cdn.thekenyatimes.com/uploads/2025/11/nairobi-360x180.png)

![Nema Closes Emirates Lounge, Bar Next Door And 6 Other Popular Nightlife Clubs [List] Ruto Announces Hiring Of 24,000 Teachers By January 2026](https://cdn.thekenyatimes.com/uploads/2025/11/nairobi-120x86.png)