Data by the Central Bank of Kenya (CBK) has revealed banks offering affordable interest rates to borrowers across the country.

According to the report, the cost of servicing personal business and corporate loans rose significantly across 2023.

Furthermore, the review showed that, Premier Bank stands out as the financial institution with the cheapest interest rate, set at nine percent, for personal loans spanning in a repayment duration of one to five years.

Ecobank follows closely at 9.9 percent, while Access Bank stands at 11.3 percent.

Still, in the ranking of the most economical banks, DTB and Kingdom Bank secured the fourth position, offering customers an interest rate of 11.4 percent for periods under five years.

Banks Least Interest Rates for more Than Five Years

Additionally, Premier Bank also had an interest rate of nine percent for the least expensive interest rates with loans offered for over five years tenure.

Following closely, Middle East Bank offered a rate of 10.1 percent, while DTB priced at 12.2 percent.

Other Banks with the least interest for loans offered for more than five years were Ecobank and Kenya Commercial Bank (KCB) with 12.2 and 12.3 percent respectively.

In terms of high interest under the tenure, SBM bank takes the lead with 18.6 percent loan interest for the period.

Absa Bank, HFC, Stanbic follow among the most expensive with over five years tenure each at a price of 16.9 percent.

UBA was also among those with expensive rates for a long period at 16.7 percent.

Also Read: CBK Licenses 19 More Digital Loan Lenders [LIST]

High Loan Interest Under Five Years

SBM banks leads as the most expensive bank with 19 percent interest on loans rendered between the period of 0ne to five years.

I&M bank and Sidian bank also had the high interest rates for the period at 18.8 and 18.3 percent respectively.

Absa, HFC, and Credit Bank both priced at a rate of 17.7 percent for loan under five years.

SBM Bank and Kingdom Bank were charging the highest interest rates on personal loans by the end of 2023 making them the most expensive Banks.

Overdraft loans

In December 2023, DIB, Bank of Africa, Housing Finance Corporation (HFC), Consolidated Bank of Kenya, and DTB offered the most affordable personal overdraft loans (for tenures less than one year).

DIB led the pack with a five percent interest rate for overdraft loans, followed by BOA and Housing Finance Corporation (HFC) with rates of 11 percent and 11.2 percent, respectively.

Consolidated Bank set their interest rate at 12.7 percent, while DTB offered a slightly higher rate of 12.9 percent.

Contrary, Kingdom Bank also had the highest overdraft facility on personal loans priced at 15.2 percent on average followed by Ecobank at which was charging interest at 14.7 percent on overdrafts.

They were followed by Gulf African Bank (14.4 percent), Middle East Bank (14.3 percent) and Gurdian Bank (14.1) percent.

Also Read: Equity Bank Increases Interest on Loans After CBK Move

CBK said that the working capital requirements have kept up with the demand for credit even as borrowers face multi- year high loan costs.

“Average interest rates on overdraft facilities-loans with tenure of less than one year-rose the highest by 2.41 percentage points between January and December last year while those on facilities exceeding five years rose slower at 1.5 per- cent, according to the CBK data,” CBK said.

In February 2024, CBK increased its base lending rate from 12.5 percent to 13 percent.

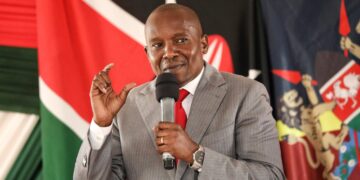

“The proposed action will ensure that inflationary expectations remain anchored, while setting inflation on a firm downward path towards the 5 per cent mid-point of the target range, as well as addressing residual pressures on the exchange rate,” said CK Governor Dr. Kamau Thugge.