Kenyan Banks have announced plans to offer cheaper loans beginning December, by lowering their interest rates.

The Kenya Bankers Association (KBA) in a statement on Sunday, December 8, indicated that the move will make borrowing more affordable for Kenyans and businesses.

Further, the association stated that the decision followed recent reductions in the Central Bank Rate (CBR) by the Central Bank of Kenya (CBK).

Starting in December 2024, banks will progressively reduce their loan rates and continue doing so as policies and risk factors evolve.

“The recent successive cuts in the Central Bank Rate, have implications on both deposit and lending rates in the market. Banks are taking steps to lower interest rates and make borrowing more affordable,” the statement read in part.

Also Read: CBK Reveals Banks with Cheapest and Most Expensive Loans

Banks Explain How They Will Implement the Move

According to KBA, loans have become too expensive, especially with the rising cost of living and tough business conditions.

By lowering rates, the banks aim to support Kenyans looking to borrow for personal needs, business growth, or even education.

“We acknowledge that many borrowers continue to face financial strains driven by the increased cost of living and of doing business;

“The protracted challenge of delayed payments to businesses; and generally low business activity due to reduced consumer demand arising from reduced disposable incomes,” added the statement.

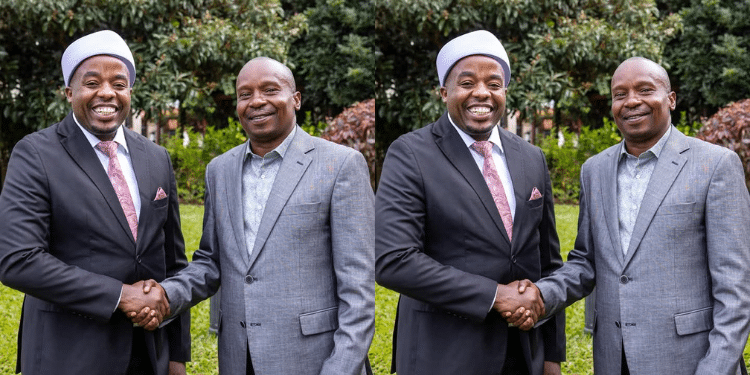

Further, KBA Chairman John Gachora said that the goal is to make borrowing not just cheaper, but also easier and more sustainable.

KBA explained that banks must balance their reduced lending rates with the cost of deposits mobilized during a period of high interest rates. These adjustments will ensure the sustainability of banking operations while easing the financial strain on borrowers.

Also Read: CBK Reduces Interest Rate on Loans

CBK Reduces Rates

On December 5, the Central Bank lowered its base lending rate from 12 per cent to 11.25 per cent citing falling global inflation.

The Monetary Policy Committee (MPC) noted that generally, global inflation has declined and central banks in the major economies are expected to gradually continue lowering interest rates.

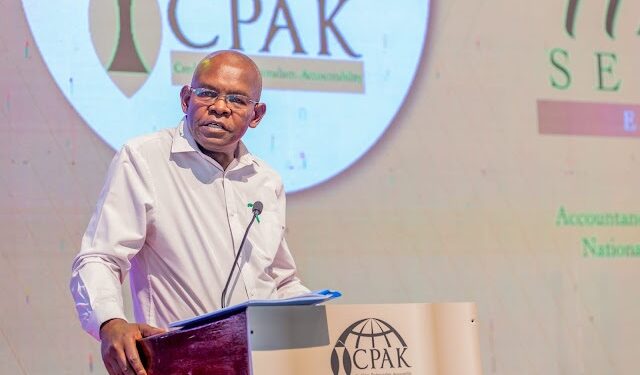

“Kenya’s overall inflation remained broadly unchanged at 2.8 per cent in November 2024 compared to 2.7 per cent in October, thereby remaining well below the midpoint of the target range of 5±2.5 per cent,” the committee chaired by CBK Governor Kamau Thugge said.

The committee attributed Kenya’s stable inflation mainly to non-food non-fuel (NFNF) inflation, which eased to 3.2 per cent in November from 3.3 per cent in October.

Follow our WhatsApp Channel and join our WhatsApp Group for real-time news updates.