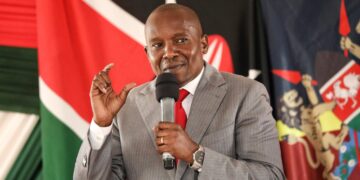

The Government has assured Kenyans that there are adequate stocks of petroleum products in the country. Petroleum and Mining Principal Secretary (PS), Andrew Kamau, insisted yesterday Kenya has adequate stocks of petrol, diesel and kerosene even as supply disruption spread to more towns across the country.

In a statement to newsrooms, the PS stated that the country has close to 81, 000 cubic meters of petrol in stock and taking into account a daily uplift of 9.400 cubic meters of the commodity. This stock can last the country for nine days.

“The country equally has over 217, 000 cubic meters of diesel in stock and with a daily uplift of slightly above 10, 000 cubic meters, the stocks can last 22 days,” he added.

Kerosene is also well stocked and the country has 55, 000 cubic meters of the commodity which can last 17 days as the daily uplift stands at 3, 251.

The PS has also disclosed that in less than a month, an additional 351, 284 cubic meters of petrol and 310, 656 cubic meters of diesel are expected. “By the end of May, Kenya will be receiving 241, 868 cubic meters of petrol and 315, 738 cubic meters of diesel,” Kamau said.

The PS sentiments come even as the Kenya Pipeline Company (KPC) also assured of sufficient stocks in all its depots across the country.

KPC Managing Director, Dr Macharia Irungu, said there were enough stocks of petroleum products in the system throughout the country to meet the demand.

He noted that KPC’s current stock position in all its facilities as Saturday 2nd April 2022 indicated that there are over 69 million litres of super petrol, more than 94 million litres of diesel, more than 13 million litres of kerosene and over 23 million litres of jet fuel available.

“Our global stock holding is adequate to serve the region, with more ships in Mombasa queued for discharge,” Dr Irungu added.

The KPC boss assured Kenyans that the state agency continues to fulfill its mandate of consistently delivering safe and quality petroleum products to all its customers in Kenya and the regional markets.

Crude prices globally have been on the increase following the Russia/Ukraine conflict. (KNA)