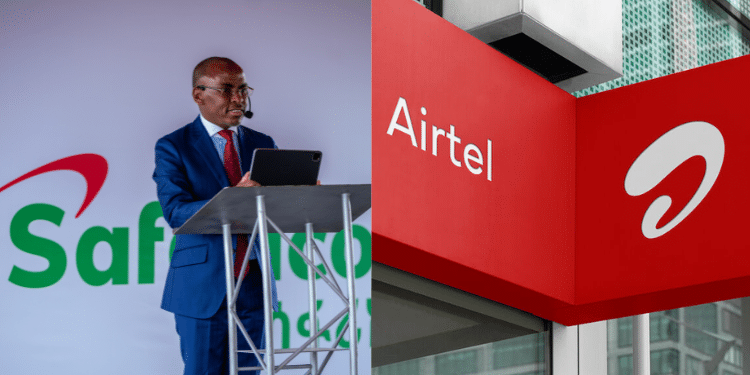

The Capital Markets Authority (CMA) has granted Safaricom Plc and Airtel Money Kenya Limited licences to operate as Intermediary Service Platform Providers (ISPPs).

In a press release shared on Monday, December 22, 2025, the Capital Markets Authority (CMA) also licensed CC Kenya Securities Limited (trading as Capital.com) to operate as a Dealing Online Foreign Exchange Broker.

This move is expected to strengthen digital access to capital markets, increase competition, and expand investment opportunities for Kenyans.

Boosting Competition and Investor Choice

The licensing of both Safaricom Plc and Airtel Money Kenya Limited to operate as intermediary service platform providers is expected to enhance healthy competition in Kenya’s digital investment space. Investors now have multiple platforms to choose from, encouraging innovation and better service offerings.

Users may benefit from lower transaction costs, more flexible investment options, and improved digital tools for monitoring portfolios.

Also Read: Safaricom to Roll Out Daily WiFi Package for Select Kenyans After Launching Ksh800 Plan

The move also pressures other financial institutions in the country to enhance their services, ultimately raising the standard of Kenya’s capital markets ecosystem.

With the new licenses, Safaricom and Airtel Money can now offer regulated capital markets products directly through their digital platforms.

These companies are now positioned to bridge the gap between everyday users and investment opportunities.

The two companies are expected to make investing simpler, faster, and more accessible, especially for first-time investors.

Growth of Online Forex and Investment Platforms

The CMA’s licensing of CC Kenya Securities Ltd (Capital.com) as a Dealing Online Forex Broker complements the expansion of digital capital market access.

Licensed dealing brokers are authorized to act as a principal and market maker in online foreign exchange trading, including opening client accounts, providing trading platforms, offering market information, monitoring positions, and issuing end-of-day reports in accordance with the Capital Markets (Online Foreign Exchange Trading) Regulations, 2017.

CMA has now licensed 13 non-dealing online forex brokers, 2 dealing online forex brokers, and three money managers operating in Kenya.

Also Read: CMA Approves Eight New Investment Schemes For Investors

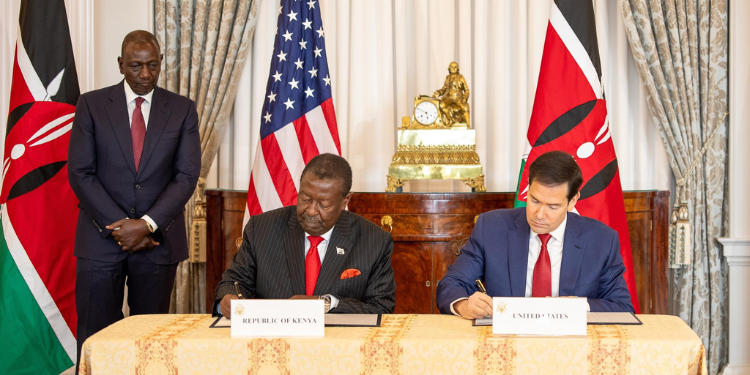

Safaricom to Roll Out KSh 40 Billion Fundraising Bond

In a statement by Company Secretary Linda Mesa Wambani on November 20, 2025, the company said the CMA approved its plan to establish a Medium-Term Note (MTN) Program on November 7.

“The Board of Directors of Safaricom PLC (the Company) is pleased to announce that the Capital Markets Authority, in exercise of its powers under Section 30A of the Capital Markets Act (Chapter 485A of the Laws of Kenya), has on 7 November 2025, approved for the Company to establish a Medium-Term Note programme,” said Safaricom’s Board of Directors.

Follow our WhatsApp Channel and X Account for real-time news updates.

![Nema Closes Emirates Lounge, Bar Next Door And 6 Other Popular Nightlife Clubs [List] Ruto Announces Hiring Of 24,000 Teachers By January 2026](https://cdn.thekenyatimes.com/uploads/2025/11/nairobi-360x180.png)