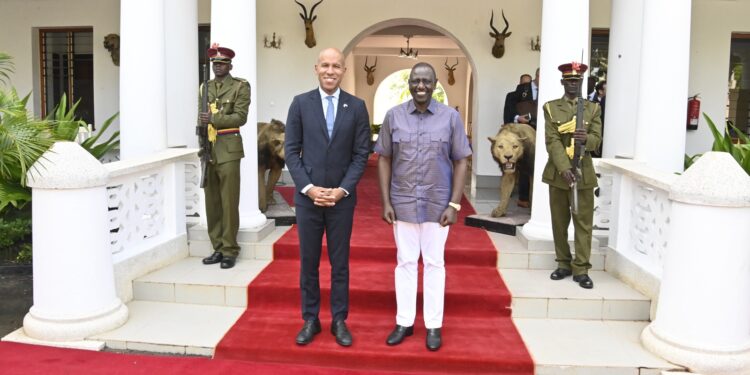

President William Ruto on Friday, July 29 pledged Kenya’s commitment to working with the US Government to strengthen its laws and regulations on money laundering and financial terrorism.

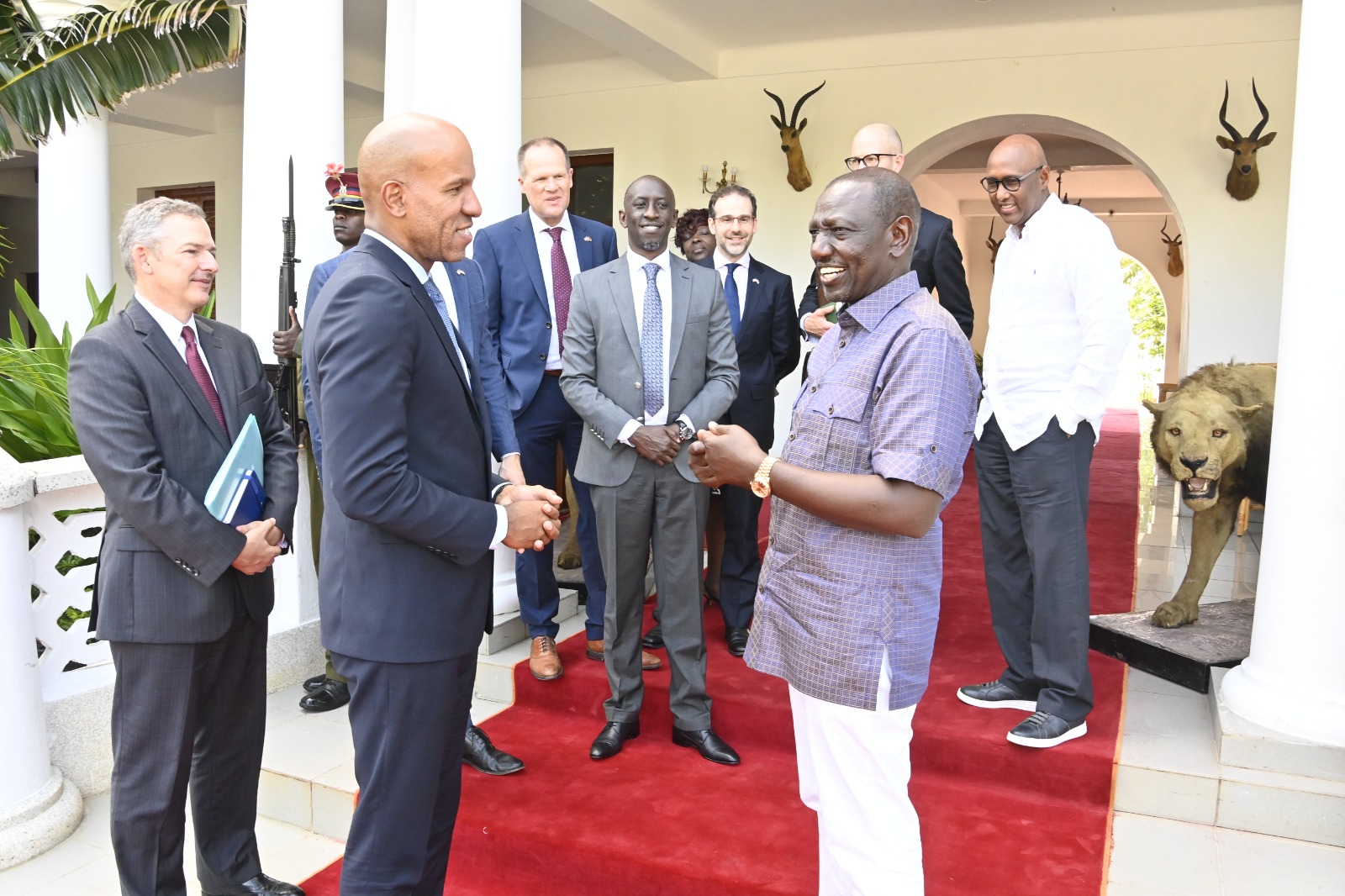

President Ruto spoke during a meeting with the US Undersecretary of the Treasury for Terrorism and Financial Intelligence Brian Nelson at State House in Mombasa.

“A firm regulatory and administrative enforcement on the source and flow of illicit funds will effectively promote integrity and stability in our financial system, thereby spurring economic growth,” he said.

The US Department of The Treasury in a statement dated July 24, detailed the agenda of the high-level meeting that sought to address key issues that include anti-money laundering.

Also Read: CBK Welcomes Money Laundering Terrorism Financing Report

Also on the agenda were discussions on countering the financing of terrorism frameworks and Treasury assistance for capacity-building.

Other areas of economic importance in focus included finding innovative solutions, including through fintech, to achieve safe financial inclusion.

“In Kenya, Under Secretary Nelson will meet with top government leaders and the private sector, including convening a roundtable of financial institutions and meeting with local fintech firms,” read the statement in part.

The meeting with President Ruto also addressed combatting illegal wildlife trafficking and terrorism which remains a major challenge to Kenya.

“…combatting illegal wildlife trafficking; and enhancing partnerships to address regional security issues, with a focus on combatting ISIS and al-Shabaab, to combat the illicit flow of funds and goods fueling instability in the region,” read part of the statement.

The Anti-Money Laundering Bill

The meeting came after the cabinet approved the Anti-Money Laundering and Combating of Terrorism Financing Amendments Bill, 2023.

Also Read: NGOs to Cite Sources of Income in Efforts to Curb Money Laundering Schemes

Some of the amendments in the Bill include relaxing the checks on large cash transactions by financial institutions.

The International Monetary Fund (IMF) is set to vet a proposal by the financial institutions to ensure it does not increase the risk of money laundering.

The amendments introduce stiffer penalties for individuals and entities found guilty of money laundering offences.

This includes higher fines and extended prison terms that are expected to act as strong deterrents against illicit financial activities.

US Top Boss First Visit to the Region

The Under Secretary is also expected to visit the neighbouring Somalia.

According to the statement, during his Somalia visit, he will discuss “Somalia’s progress toward debt relief this year under the HIPC framework, as well as the prolonged spillover effects in the region of Russia’s war against Ukraine. He will highlight the continued sanctions exemptions for food and agricultural transactions…”

This marks his second trip to the continent and the first to East Africa.